Bullish bitcoin positions funded with borrowed money are building rapidly on Bitfinex even as prices continue to slide, pushing margin longs to their highest level in nearly two years.

Margin long positions on the exchange have climbed to roughly 77,100 BTC, the largest total since December 2023, when bitcoin was trading closer to $40,000, according to TradingView data. The increase comes as bitcoin slipped below $69,000 for the first time since November 2024.

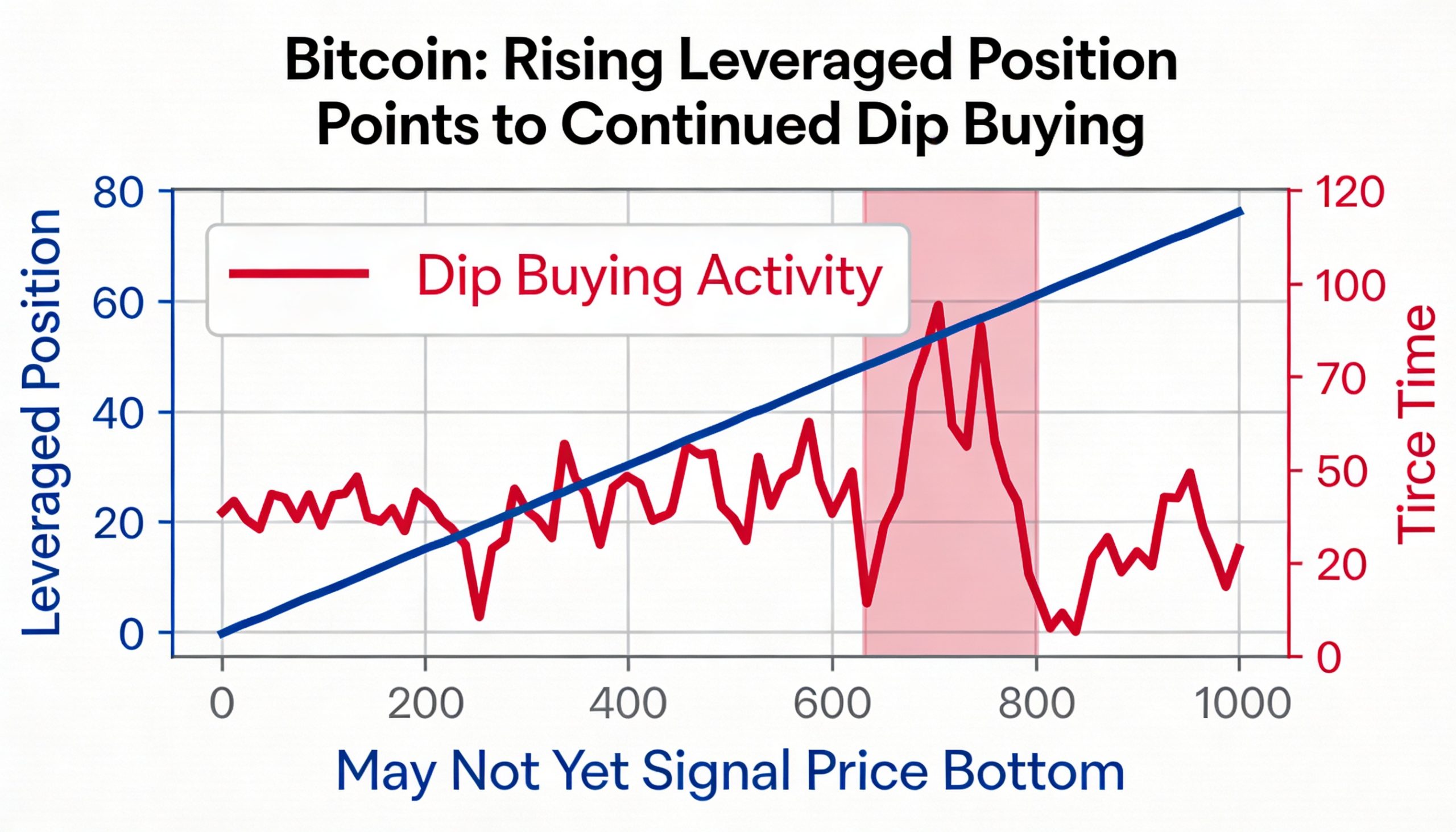

Over the past six months, margin longs have surged 64%, while bitcoin has fallen nearly 50% from its October record high. The divergence suggests that a large market participant — often referred to as a whale — may be steadily accumulating bitcoin throughout the correction.

Historically, Bitfinex margin long positioning has functioned as a contrarian signal. Long exposure on the platform tends to expand during periods of market stress and contract during price recoveries.

At prior cycle lows, margin long positions were elevated as prices stabilized and bottomed. Similar behavior was observed during the FTX collapse in November 2022, the August 2024 carry-trade unwind, and the so-called “tariff tantrum” in April 2025.

The latest buildup in margin longs comes as bitcoin is on pace for a fifth straight monthly decline. While the aggressive dip buying points to confidence among leveraged buyers, the continued expansion in long exposure may also indicate that the market has yet to reach a clear price bottom.