Robinhood’s Q2 Beats Expectations, But Analysts Stay Cautious Despite Price Target Bumps

Robinhood (HOOD) delivered a strong second-quarter earnings report, lifting its share price slightly to $106.50 on Thursday morning. While Wall Street responded with upward revisions to price targets, analysts largely held their neutral ratings, suggesting the stock’s explosive rally since April may have already baked in much of the upside.

Having nearly tripled in value since mid-April and gained over 420% year-over-year, Robinhood’s performance has left analysts impressed — but wary.

Wall Street Raises Targets, Holds Ratings

Citi raised its price target from $100 to $120 but maintained a neutral stance. Analyst Christopher Allen revised earnings estimates sharply higher, yet warned that current valuations appear to reflect much of Robinhood’s potential growth. JPMorgan also stuck with a neutral rating while increasing its 2026 price target from $98 to $104. Analyst Kenneth Worthington pointed to a highly favorable market environment — strong volatility, high retail trading, and elevated interest rates — as key drivers for HOOD’s solid quarter.

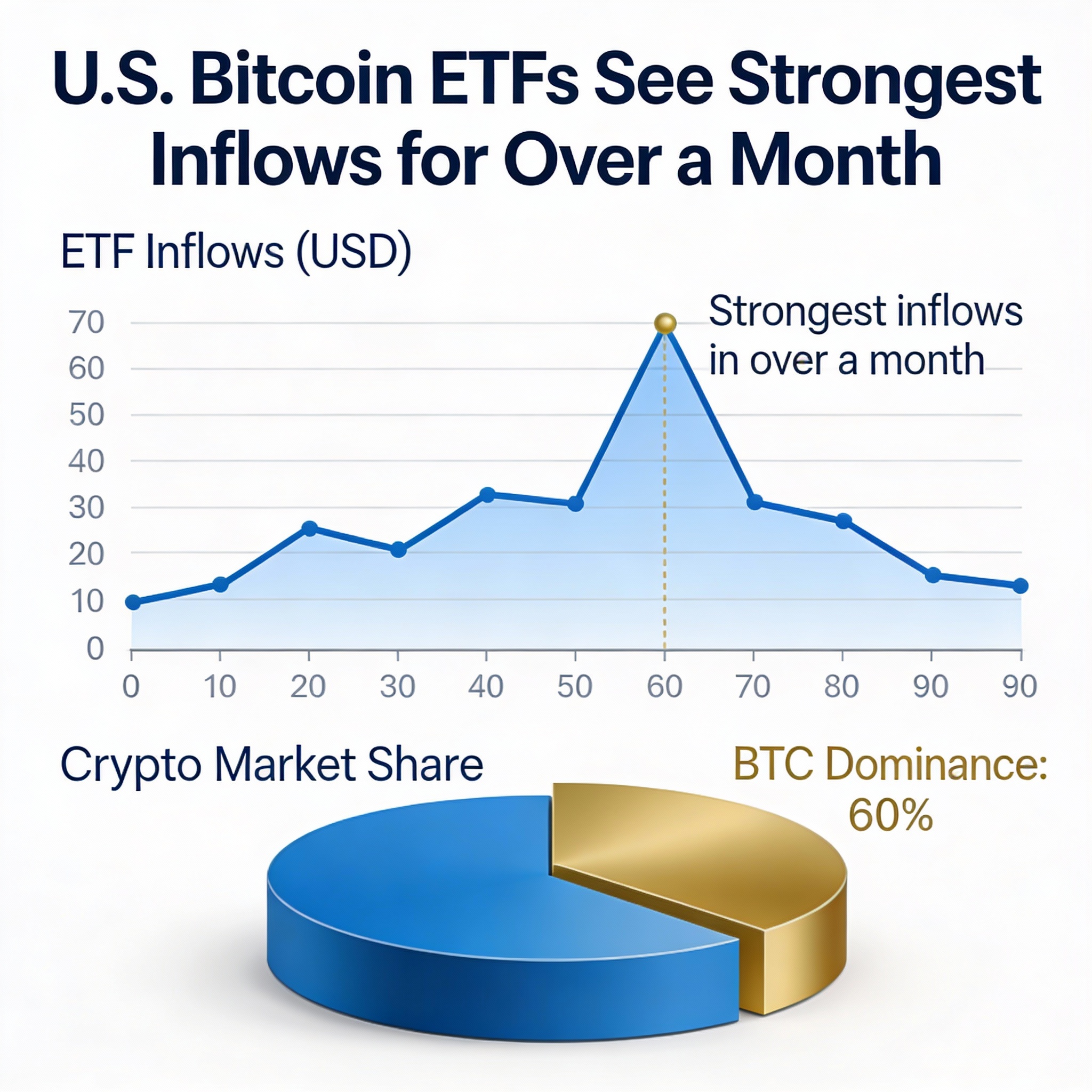

Worthington highlighted the impact of Robinhood’s Bitstamp acquisition, which contributed $160 million in crypto revenue, about 16% of the company’s total. Bitstamp also added $6.7 billion in notional crypto volume for the quarter.

Keefe, Bruyette & Woods (KBW) followed suit, raising its target from $89 to $106 but holding its neutral outlook. KBW credited the firm’s earnings beat to improved user engagement, rising margins, and a rebound in both securities lending and crypto activity. The firm also revised its EPS projections upward through 2027.

Cantor Fitzgerald Remains Bullish

Cantor Fitzgerald’s Brett Knoblauch stood out as the only analyst with a buy rating on HOOD. He raised his price target from $100 to $118, citing continued growth in Robinhood’s crypto, options, and interest income lines. He values the company at 40x 2026 EV/EBITDA and sees further upside through upcoming launches like Robinhood Banking, staking services, and its “Strategies” platform. Knoblauch believes the company’s momentum is still building across several verticals.

Implications for Coinbase Earnings

Robinhood’s strong crypto revenue — bolstered by Bitstamp’s institutional flows and a rebound in retail participation — could have implications for Coinbase, which is set to report earnings later today.

While Coinbase’s core business is more dependent on crypto than Robinhood’s diversified model, analysts say a similar uptick in retail trading could signal improving market sentiment. However, Coinbase lacks Robinhood’s exposure to interest and lending income, making it more vulnerable to swings in crypto volumes.

FactSet projects Coinbase will report Q2 revenue of $1.59 billion and earnings per share of $1.25 — both up from a year earlier. COIN shares were up 1.6% on Thursday, trading at $383.56 ahead of the report.