As market uncertainty deepens and traditional safe havens shine once more, tokenized gold is stepping into the spotlight.

The market cap of digital gold assets—cryptocurrencies backed 1:1 by physical gold—has surged to just under $2 billion, growing 5.7% in the last 24 hours, according to CoinGecko. The rally coincides with physical gold briefly notching a new record above $3,170 per ounce, amid intensifying geopolitical risks and tariff turmoil.

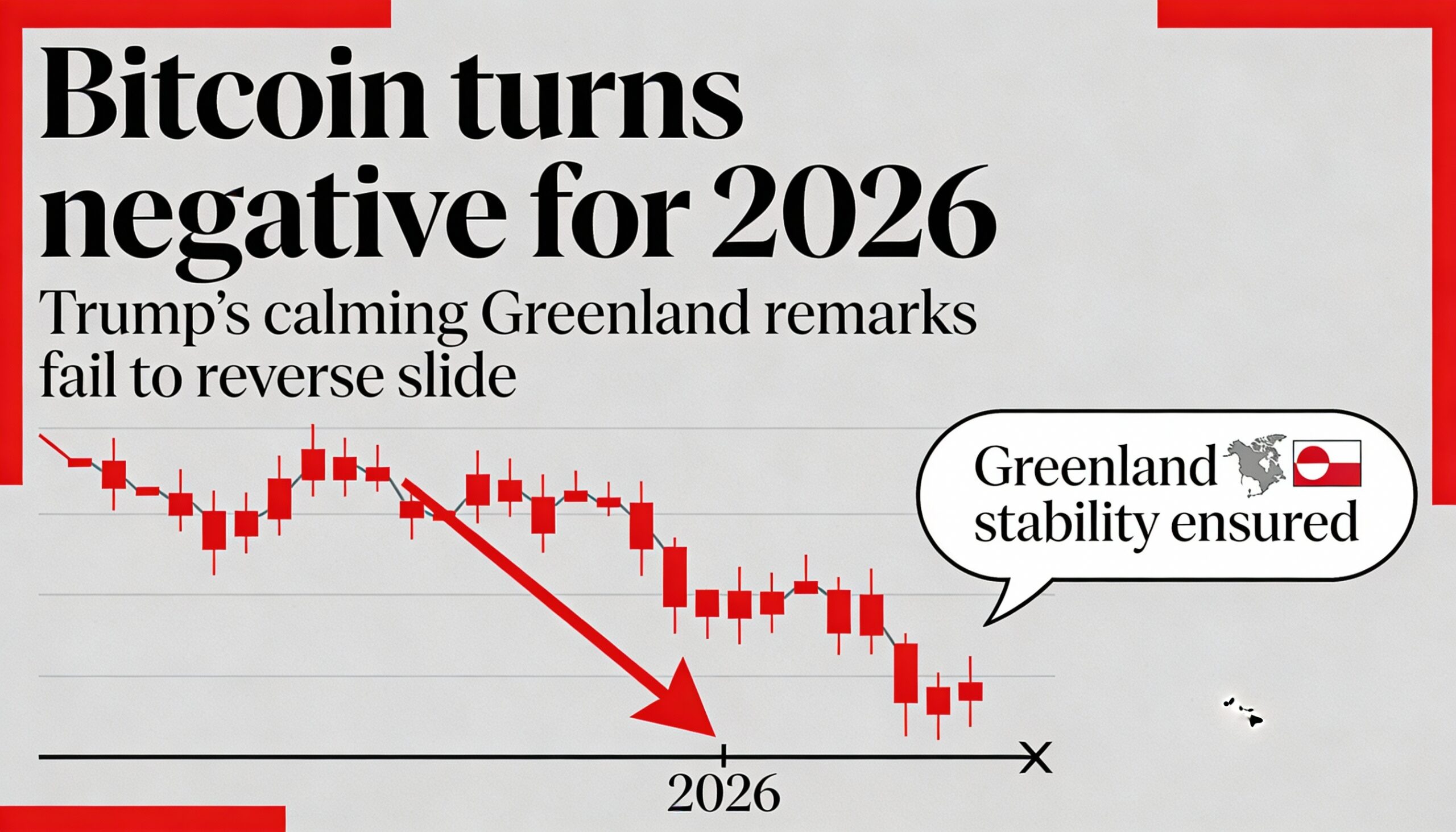

This surge marks one of the strongest performances among crypto sectors since U.S. President Donald Trump resumed his aggressive tariff agenda earlier this year. According to a new report by CEX.IO, tokenized gold outpaced both bitcoin and stablecoins in market cap growth since January 20, rising 21%, while bitcoin dropped 19% and stablecoins rose just 8%.

Top players like Paxos Gold (PAXG) and Tether Gold (XAUT) led the charge, seeing trading volumes spike 900% and 300% respectively. Weekly volumes in tokenized gold overall have now surpassed $1 billion—the highest since the March 2023 banking instability.

Even a brief dip in gold during the wider market sell-off wasn’t enough to cool demand. Prices rebounded quickly, reinforcing gold’s role as a reliable store of value—even in its tokenized form.

“Tokenized gold is proving its value as a digital hedge,” said Alexandr Kerya, VP of Product at CEX.IO. “It allows users to escape volatility without leaving the crypto ecosystem.”

With growing demand for real-world asset (RWA) exposure in DeFi and a shaky macro backdrop, tokenized gold appears poised for continued growth—bridging the gap between traditional finance and digital innovation.