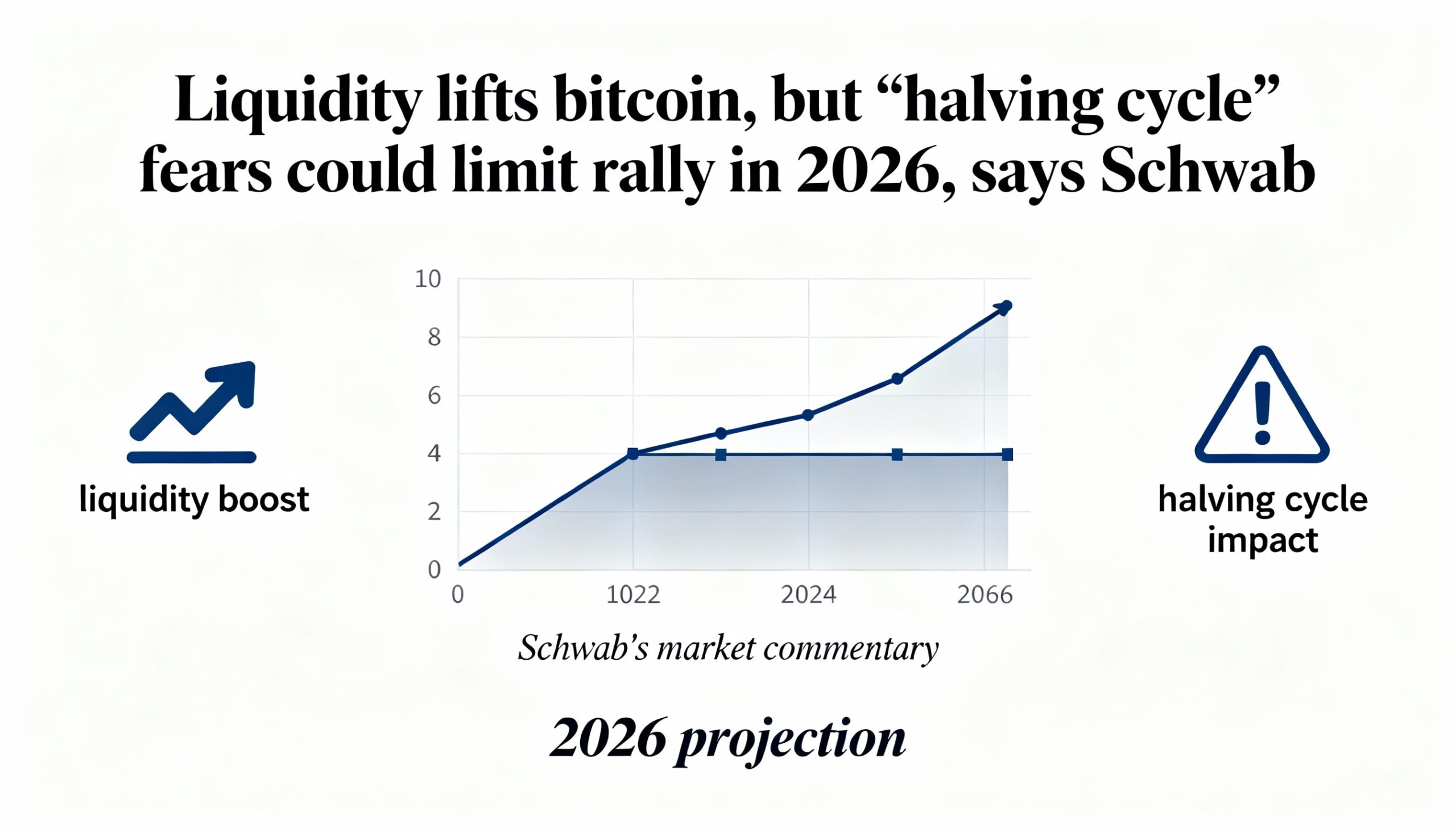

Schwab: Bitcoin Supported by Liquidity, but Halving Cycle and Adoption Concerns Could Limit 2026 Upside

Bitcoin (BTC $91,452.15) heads into 2026 influenced by a combination of macro trends and market-specific factors, according to Jim Ferraioli, director of crypto research and strategy at the Schwab Center for Financial Research.

Ferraioli highlights three long-term drivers—global M2 money supply, Bitcoin’s disinflationary supply growth, and adoption—alongside seven short-term factors, including market risk sentiment, interest rates, U.S. dollar strength, seasonality, central bank liquidity, large wallet concentration, and financial contagions.

Several short-term factors currently favor Bitcoin. Credit spreads remain tight, and much of the speculative derivative activity that fueled late-2025 volatility has already unwound. “A risk-on environment in equities should support crypto—the ultimate risk asset,” he said.

Monetary policy adds further support. With quantitative tightening over and balance sheets expanding, rates and the dollar are expected to decline, boosting liquidity.

Still, headwinds persist. Adoption could slow in early 2026 after last year’s volatility, though regulatory clarity, such as the Clarity Act, could accelerate institutional participation. The halving cycle also presents a potential drag; historically, the third year of the cycle has been weak. While Bitcoin has averaged around 70% gains from annual lows since 2017, Ferraioli expects 2026 returns to be more modest.

He also notes a shift in correlations: Bitcoin remains closely tied to megacap AI stocks, but its connection to broader equities is weakening, suggesting it may behave more independently from traditional markets in the year ahead.