U.S.-listed bitcoin ETFs are displaying notable resilience, with assets under management slipping just 4% even as bitcoin’s price has fallen roughly 25%, creating a clear divergence between ETF demand and broader market behavior.

Short-term holders (STHs) are now sitting almost entirely in the red on their recent bitcoin purchases. Glassnode classifies STHs as entities holding BTC for fewer than 155 days, and on June 15 — exactly 155 days ago — bitcoin traded near $104,000. With current prices well below that level, nearly every coin acquired since mid-June is now underwater.

Glassnode’s data shows roughly 2.8 million BTC held by STHs are at a loss, marking the highest level of short-term-held supply in the red since the FTX collapse in November 2022, when bitcoin briefly fell toward $15,000.

Despite the price retreat, bitcoin’s drawdown remains consistent with prior bull-market corrections, which typically range between 20% and 30%. Long-term holders (LTHs), however, have been reducing exposure. LTH supply has declined from 14,755,530 BTC in July to 14,302,998 BTC as of Nov. 16 — a net reduction of 452,532 BTC.

“Many long-standing holders chose to sell in 2025 after years of accumulation,” said Bitcoin OG and Fragrant Board Director Nicholas Gregory. He noted these sales were largely “lifestyle driven,” not reflective of bearish sentiment, and that the combination of U.S. spot ETF launches and bitcoin reaching the $100,000 region created an appealing and highly liquid window for distribution.

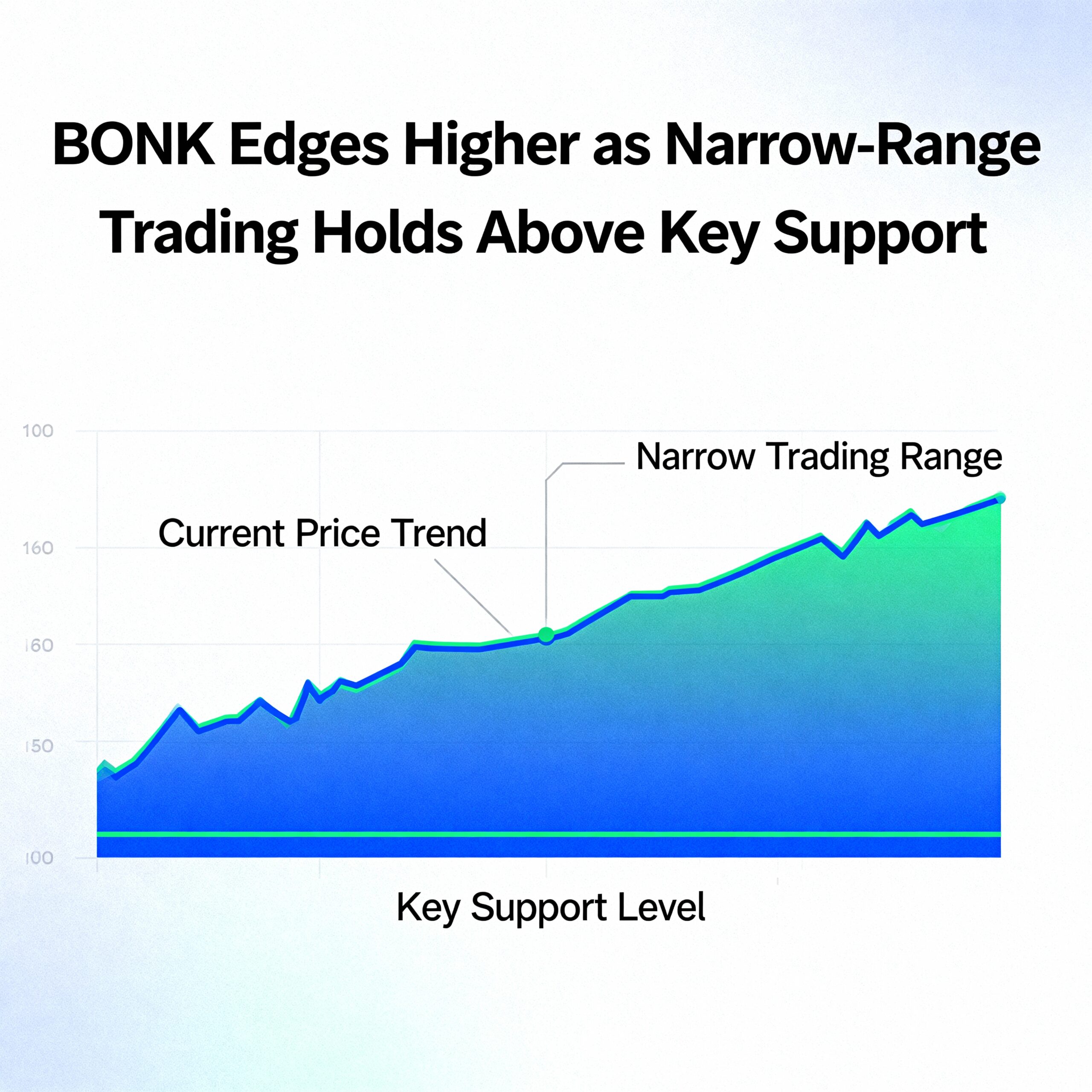

Meanwhile, U.S. spot bitcoin ETFs continue to hold steady. Their combined assets under management stand at 1.33 million BTC, only a 3.6% decline from the all-time peak of 1.38 million BTC on Oct. 10, according to Checkonchain data. Importantly, measuring AUM in BTC instead of dollars eliminates distortions caused by price volatility.

The stability of ETF balances — despite bitcoin’s price decline — suggests the current drawdown is being driven not by ETF outflows, but by selling pressure from longer-term holders.