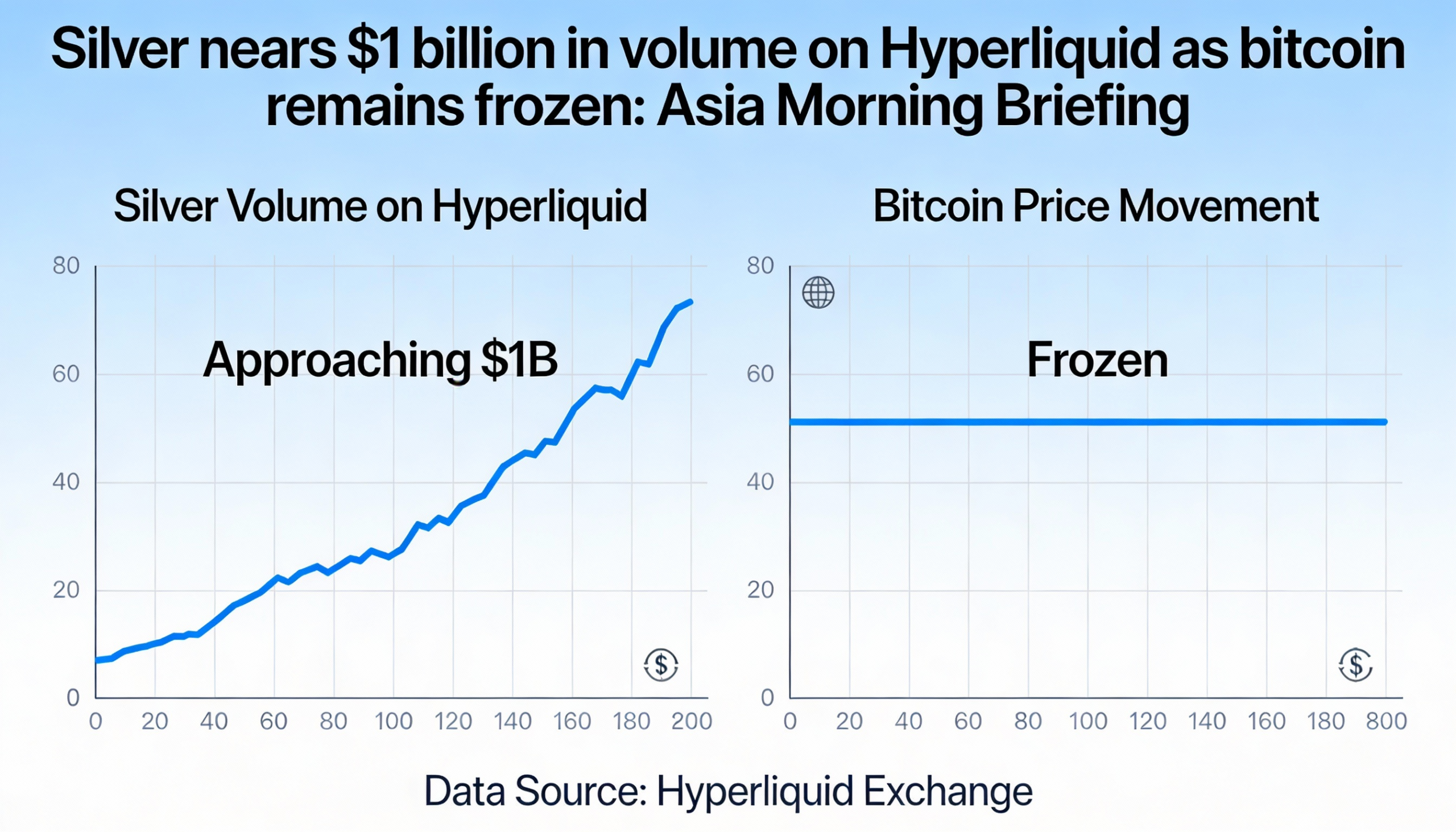

Silver volume surges on Hyperliquid as bitcoin stalls

Silver has become a headline market on Hyperliquid, highlighting a shift in how crypto derivatives are being used as bitcoin struggles to find direction.

The SILVER-USDC perpetual contract has emerged as one of the platform’s most active markets, trading around $110 during Asia hours with roughly $994 million in 24-hour volume. Open interest sits near $154.5 million, while slightly negative funding rates suggest heavy two-way activity rather than a one-sided leveraged trade. For a crypto-native perpetual market, this points to hedging and volatility-driven positioning rather than speculative longs.

Silver’s prominence is particularly notable. According to CoinGecko data, its volume ranks just behind BTC and ETH pairs and ahead of SOL and XRP. That a commodity is generating comparable activity to major crypto assets indicates traders are using crypto infrastructure for macro and hedging strategies that bitcoin and ether no longer capture efficiently. In short, decentralized exchanges are increasingly serving as venues for macro-oriented trades.

Bitcoin itself remains range-bound. Glassnode data shows BTC in a defensive equilibrium, with cumulative spot volume delta turning sharply negative as sellers press bids on rallies. ETF inflows have cooled, derivatives open interest has eased, funding is uneven, and options skew has risen—signaling rising demand for downside protection rather than conviction on the upside.

As a result, bitcoin absorbs selling pressure without collapsing, yet lacks momentum to trend. Price stability near $88,000 masks cautious positioning and restrained leverage deployment, with ETH’s relative underperformance reinforcing the market’s lack of risk appetite. Meanwhile, the rise of silver trading on Hyperliquid reflects where macro uncertainty is being priced.

Market Snapshot

- BTC: Hovering near $88,000, trading sideways as persistent selling and cautious positioning cap rallies.

- ETH: Around $2,300, down on the week and underperforming BTC as leverage and risk appetite remain muted.

- Gold: Extending its breakout, up roughly 15% over the past 30 days and more than 50% over six months, reinforcing macro stress flows toward hard assets.

- Nikkei 225: Flat in Asia trade, even as South Korean auto stocks swung on renewed U.S. tariff concerns; mixed regional performance with chip-led gains in Seoul and Australia offsetting weakness in China.