Ahead of President-elect Donald Trump’s inauguration, speculation is growing around the possibility of a national digital asset reserve, with altcoins potentially joining Bitcoin (BTC) as part of the U.S. government’s strategy.

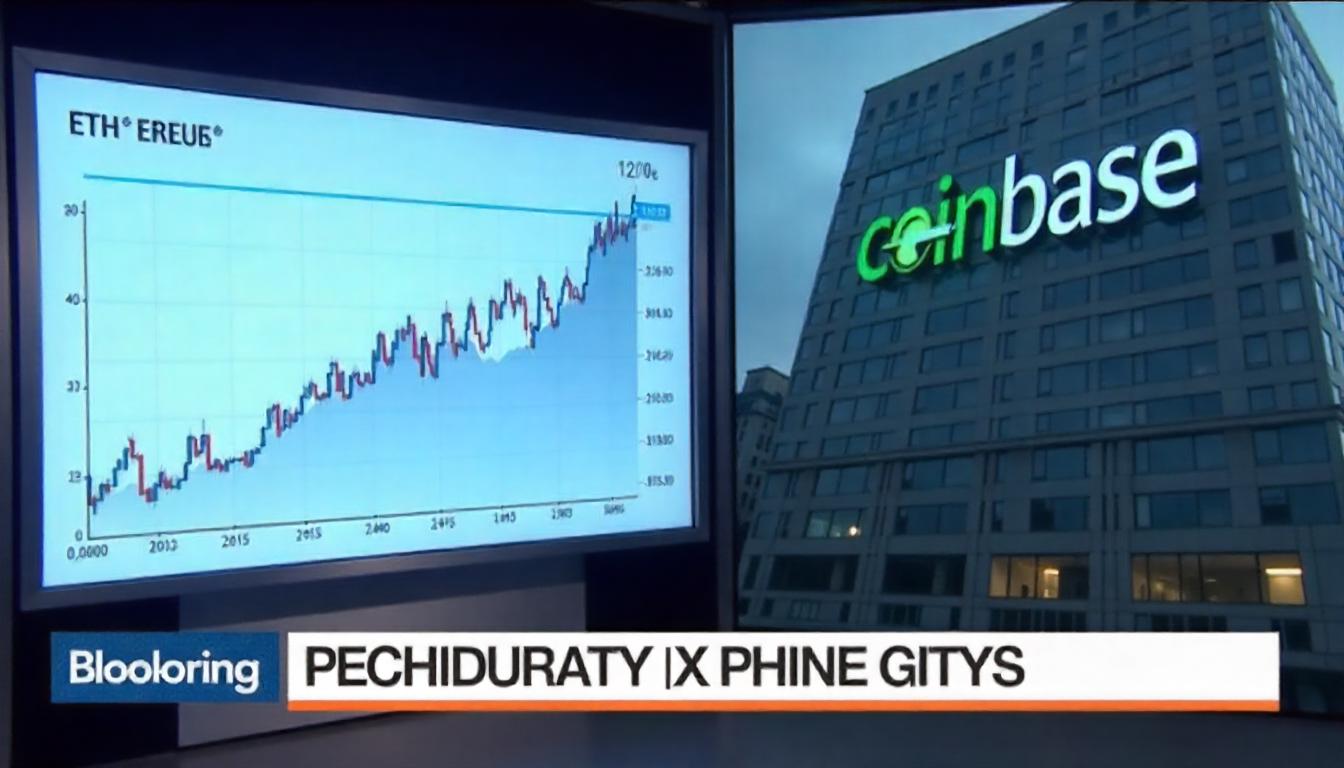

Reports have surfaced indicating that Trump is considering the creation of an “America-first strategic reserve” for digital assets, including Bitcoin and potentially popular altcoins like Solana (SOL), XRP, and Hedera (HBAR). This news has caused a significant surge in these altcoins, with Solana jumping 8% to $217, XRP rising to $3.35, and Hedera gaining over 10%, marking a 5% increase in the CoinDesk 20 Index.

Bitcoin’s price remained stable, increasing 0.5%, nearing $100,000, while the rally in altcoins outperformed the leading cryptocurrency. The rise in altcoins has come amid anticipation of Trump’s inauguration on January 20, with crypto traders expecting the incoming administration to enact policies favorable to the digital asset market.

Trump’s pro-crypto stance during the campaign, including the promise of creating a national bitcoin reserve, has made waves in the crypto community. However, the idea of including altcoins in the reserve has caused debate, especially considering the decentralized nature of many cryptocurrencies. Some market participants have voiced concerns about the risks of the U.S. government stepping into the crypto space by potentially nationalizing altcoins, which could undermine the decentralization ethos that cryptocurrencies stand for.

Quinn Thompson, founder of hedge fund Lekker Capital, voiced skepticism about the government’s involvement in altcoins, calling it a misguided idea. “The focus should remain on Bitcoin, as the only truly decentralized cryptocurrency, while altcoins should not be nationalized,” Thompson said.

Anthony Georgiades from Innovating Capital echoed similar sentiments, stating that while supporting U.S. innovation is essential, introducing government control over digital assets could weaken the fundamental principles of blockchain decentralization.

Despite the debate, the notion of a national crypto reserve continues to energize markets, with traders closely watching developments in the coming weeks as the new administration takes office. Whether Bitcoin will remain the only digital asset in the reserve, or whether altcoins like Solana, XRP, and HBAR will be included, remains to be seen.