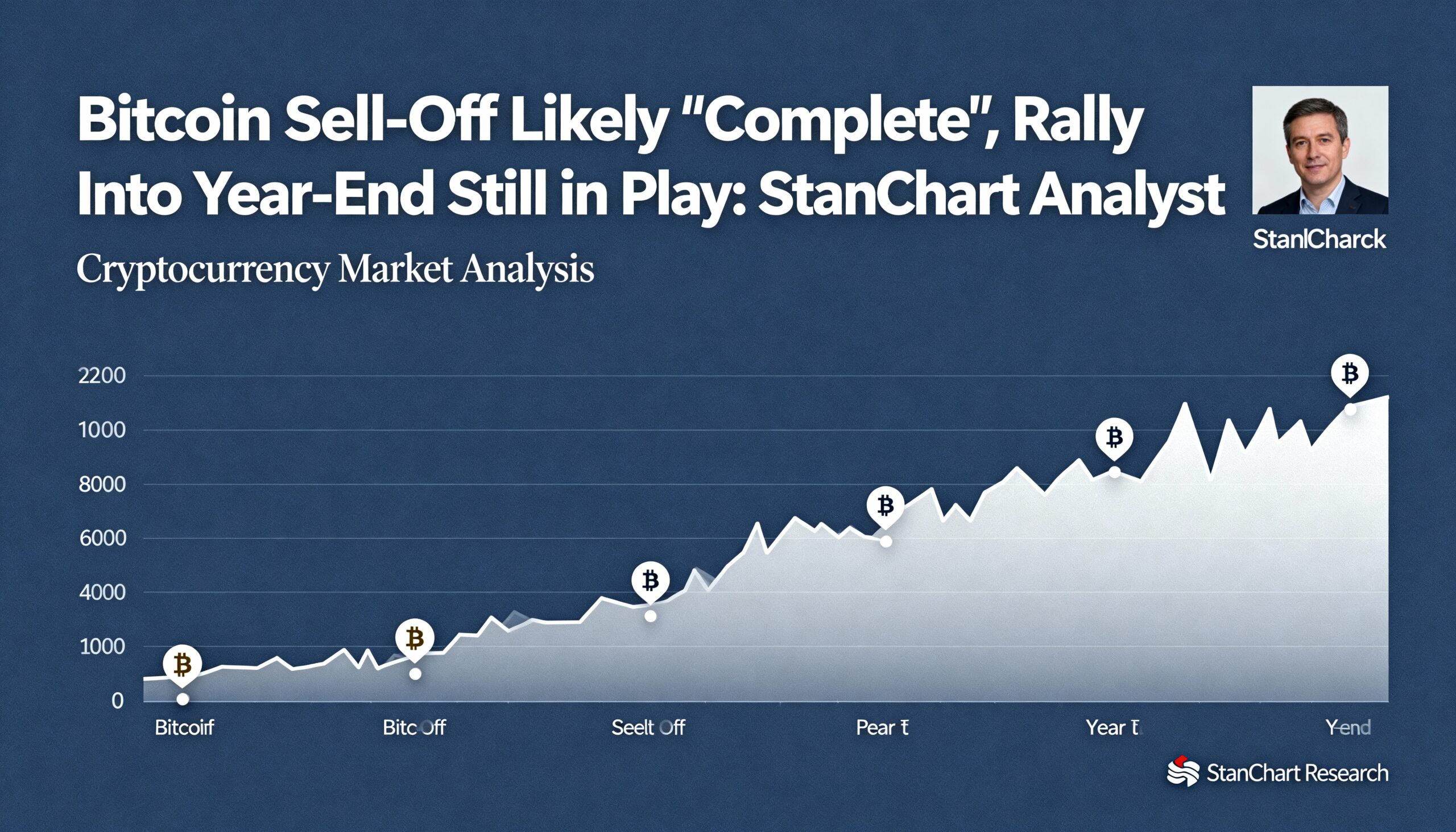

Standard Chartered Analyst Sees Bitcoin Sell-Off Nearing End, Year-End Rally Possible

Bitcoin’s sharp pullback may be close to over, according to Geoffrey Kendrick, head of digital asset research at Standard Chartered. He says the recent decline follows a familiar pattern and is showing signs of exhaustion.

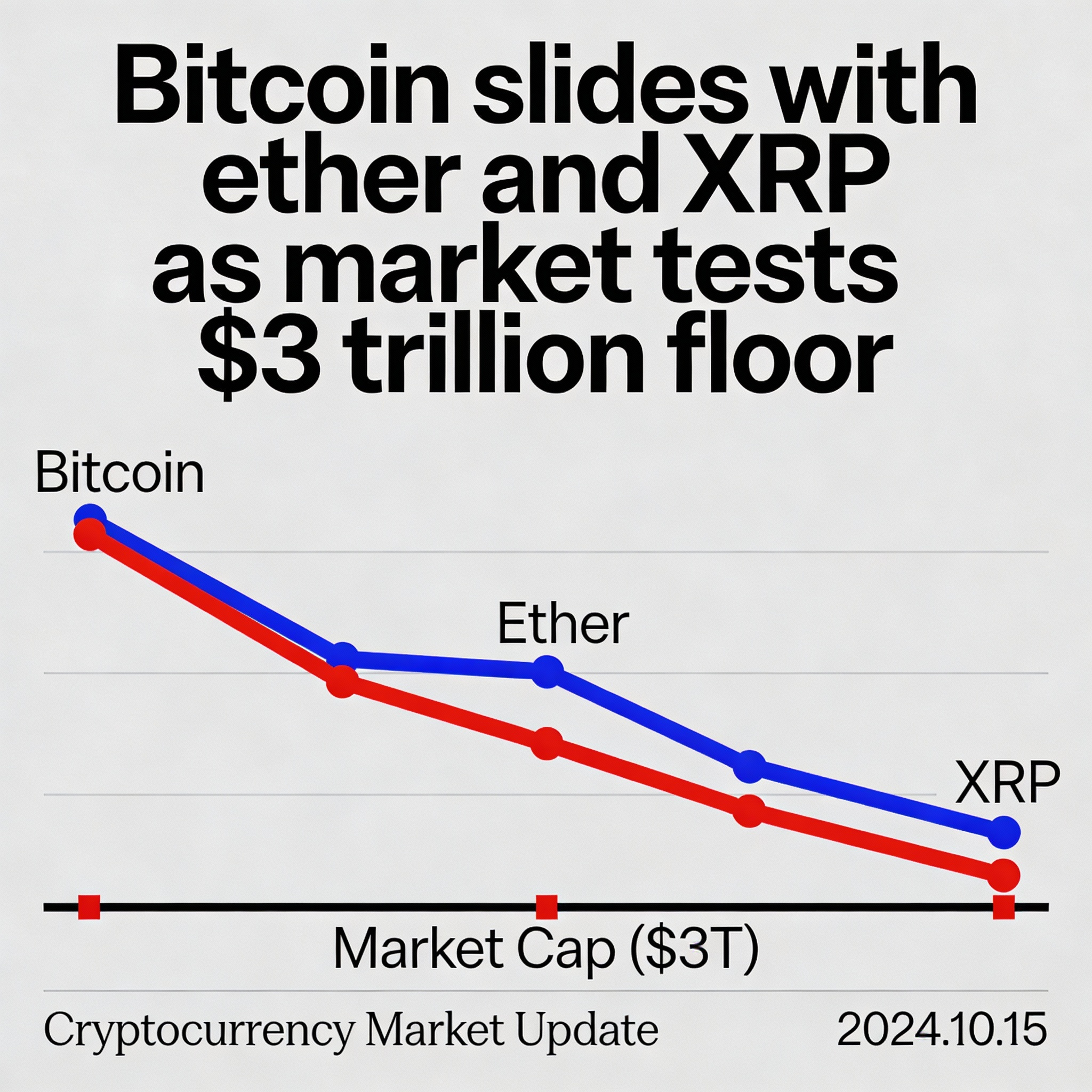

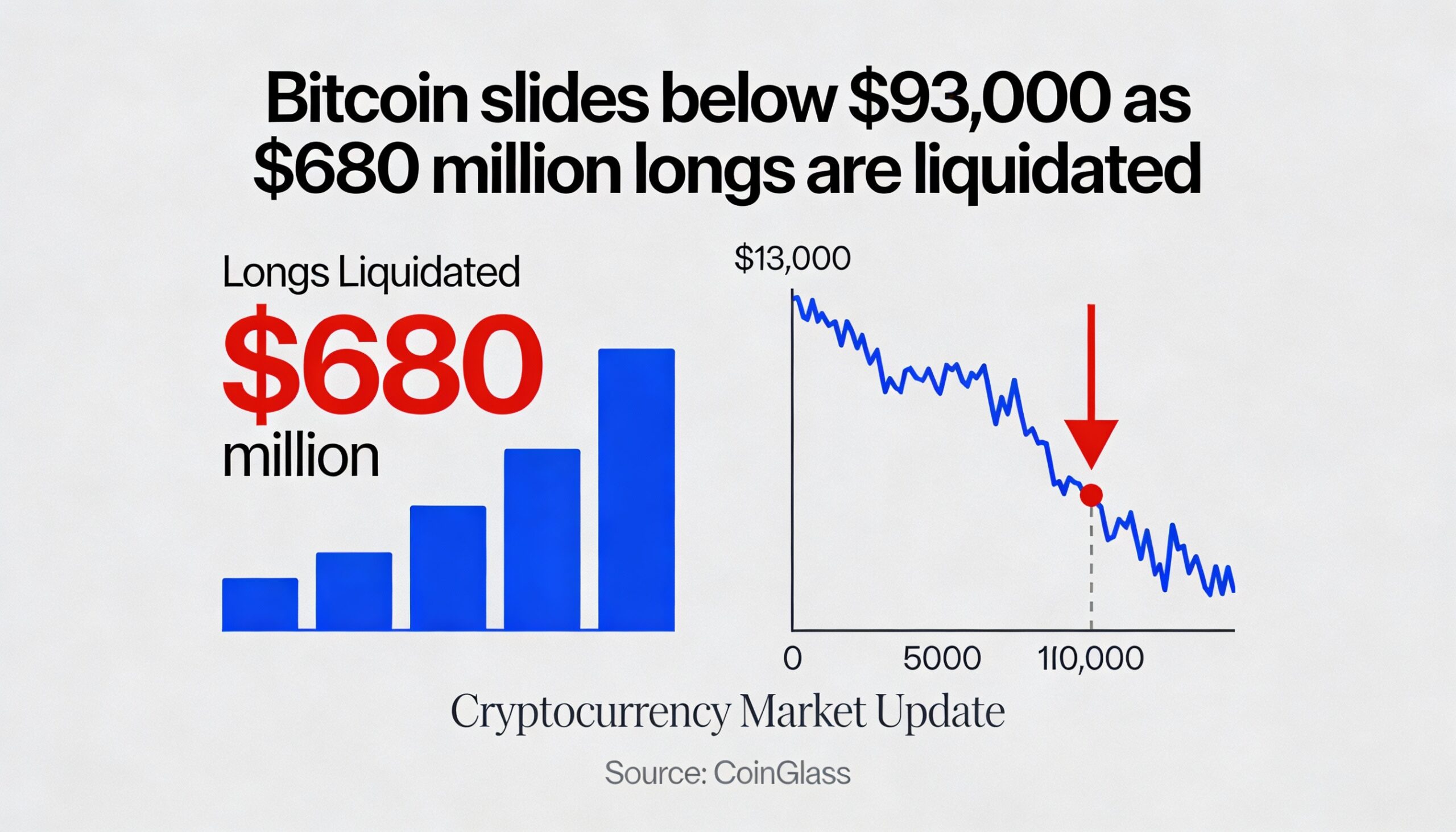

Bitcoin BTC$84,537.42 fell below $90,000 on Tuesday, extending a roughly 30% drop from its early October all-time high above $126,000. The decline marks the deepest pullback since U.S. spot bitcoin ETFs launched last year, prompting debate about whether the cryptocurrency is entering a typical four-year cycle bear phase.

Kendrick described the sell-off as “a fast, painful version of the third decline over the past few years, nearly identical in magnitude.” He noted that key sentiment and valuation metrics, including MicroStrategy’s modified net asset value (mNAV), have reset to historically bottom-like levels. Other indicators have collapsed to near zero, signaling capitulation and seller exhaustion.

“A rally into year-end is my base case,” Kendrick said. His outlook aligns with Bitfinex analysts, who point to slowing realized losses among short-term holders and emerging on-chain capitulation signals—common markers of market bottoms.

Bitcoin bounced to just under $93,000 on Tuesday, up 3.8% from overnight lows.