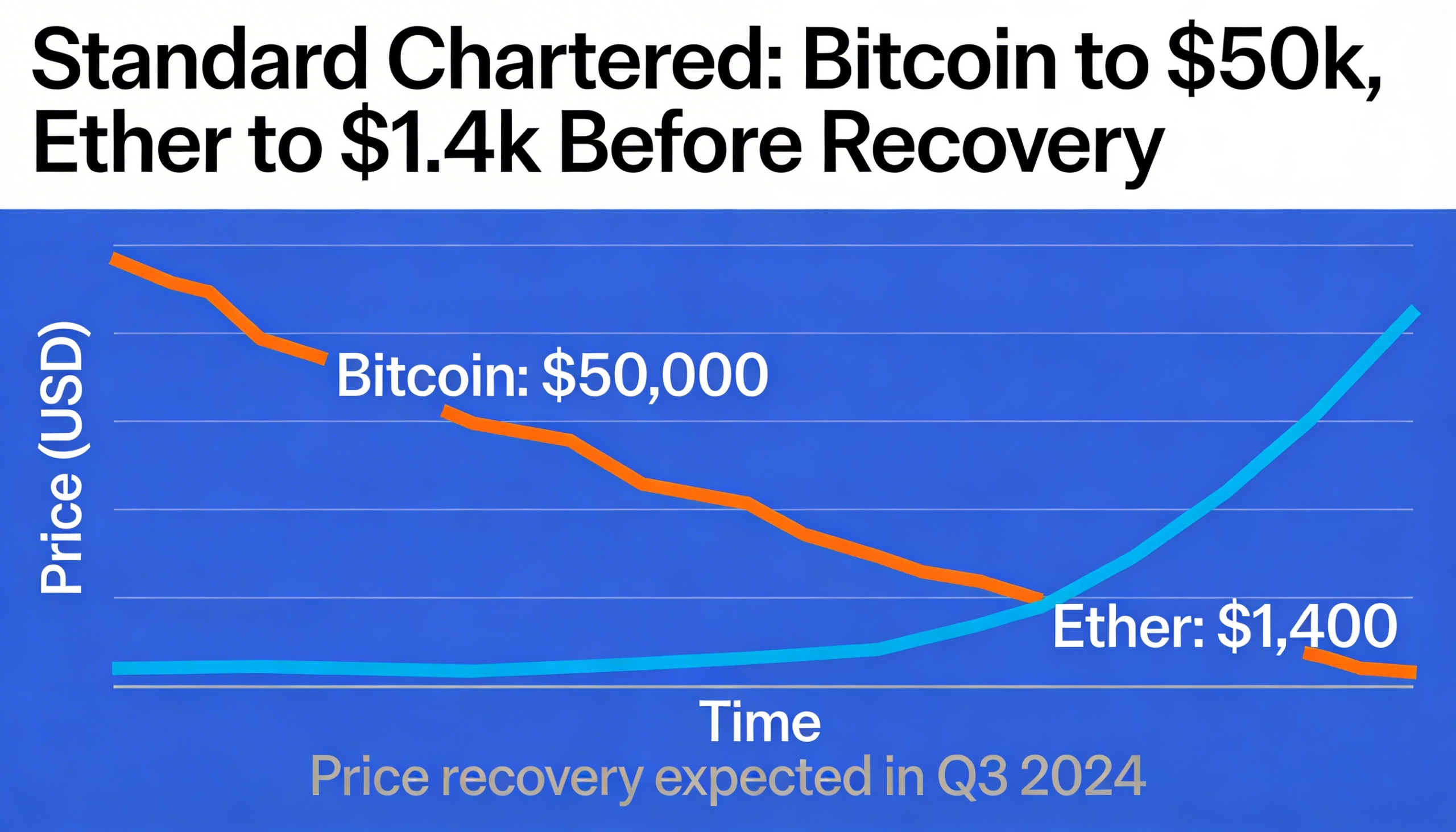

Standard Chartered has lowered its short-term and 2026 cryptocurrency forecasts, cautioning that further downside may be ahead as ETF outflows and macroeconomic pressures continue to weigh on digital assets.

The bank now expects bitcoin to retreat toward $50,000 in the coming months, with ether potentially falling to around $1,400 before establishing a base. At publication, bitcoin was trading near $67,900, while ether hovered around $1,980.

Geoff Kendrick, the bank’s head of digital assets research, said recent selling pressure could intensify as investors in crypto exchange-traded funds — many currently holding unrealized losses — are more likely to trim positions than aggressively buy dips.

While Kendrick anticipates a recovery once prices stabilize, he has revised his year-end 2026 targets lower. The bank now sees bitcoin reaching $100,000 by year-end, down from its prior $150,000 forecast. Ether’s target was cut to $4,000 from $7,500. Forecasts for other major tokens were also reduced: solana to $135 from $250, BNB to $1,050 from $1,755, and AVAX to $18 from $100.

The broader crypto market has struggled in early 2026, with bitcoin down nearly 23% since the start of the year and well below its late-2025 highs. Total market capitalization has contracted sharply amid elevated volatility and widespread liquidations of leveraged positions.

Risk sentiment has deteriorated alongside weaker equity markets, increasing crypto’s correlation with traditional risk assets. Concerns about global economic growth and uncertainty around interest-rate policy have driven investors toward defensive assets such as gold. Meanwhile, lingering regulatory uncertainty in the U.S. and liquidity strains at certain firms have further undermined confidence, pressuring trading volumes and revenues across the sector.

Kendrick noted that bitcoin ETF holdings have fallen by nearly 100,000 BTC from their October 2025 peak. With the average ETF entry price around $90,000, many holders are facing unrealized losses of roughly 25%, increasing the risk of additional outflows.

Macroeconomic conditions also offer limited near-term relief. Although U.S. data suggests some economic softening, markets are not pricing in rate cuts before Kevin Warsh’s first Federal Open Market Committee meeting as Federal Reserve chair in mid-June, reducing expectations for immediate policy support.

Despite the weakness, the bank emphasized that the current downturn remains less severe than previous crypto bear markets. At its February low, bitcoin had declined about 50% from its October 2025 all-time high, with roughly half of the circulating supply still in profit — a notable correction, but milder than prior cycle drawdowns.

Importantly, this cycle has not been accompanied by the collapse of major crypto platforms, unlike the failures of Terra/Luna and FTX in 2022. Kendrick said that absence of systemic failures points to a more mature and resilient asset class.

The bank maintained its long-term outlook, leaving its end-2030 projections unchanged at $500,000 for bitcoin and $40,000 for ether, citing continued adoption and enduring structural growth drivers.