Strategy Sets $1.44B Cash Reserve, Cuts Profit and Bitcoin Yield Targets

Strategy (MSTR), led by Executive Chairman Michael Saylor, added to its bitcoin holdings last week, bringing its total to 650,000 BTC.

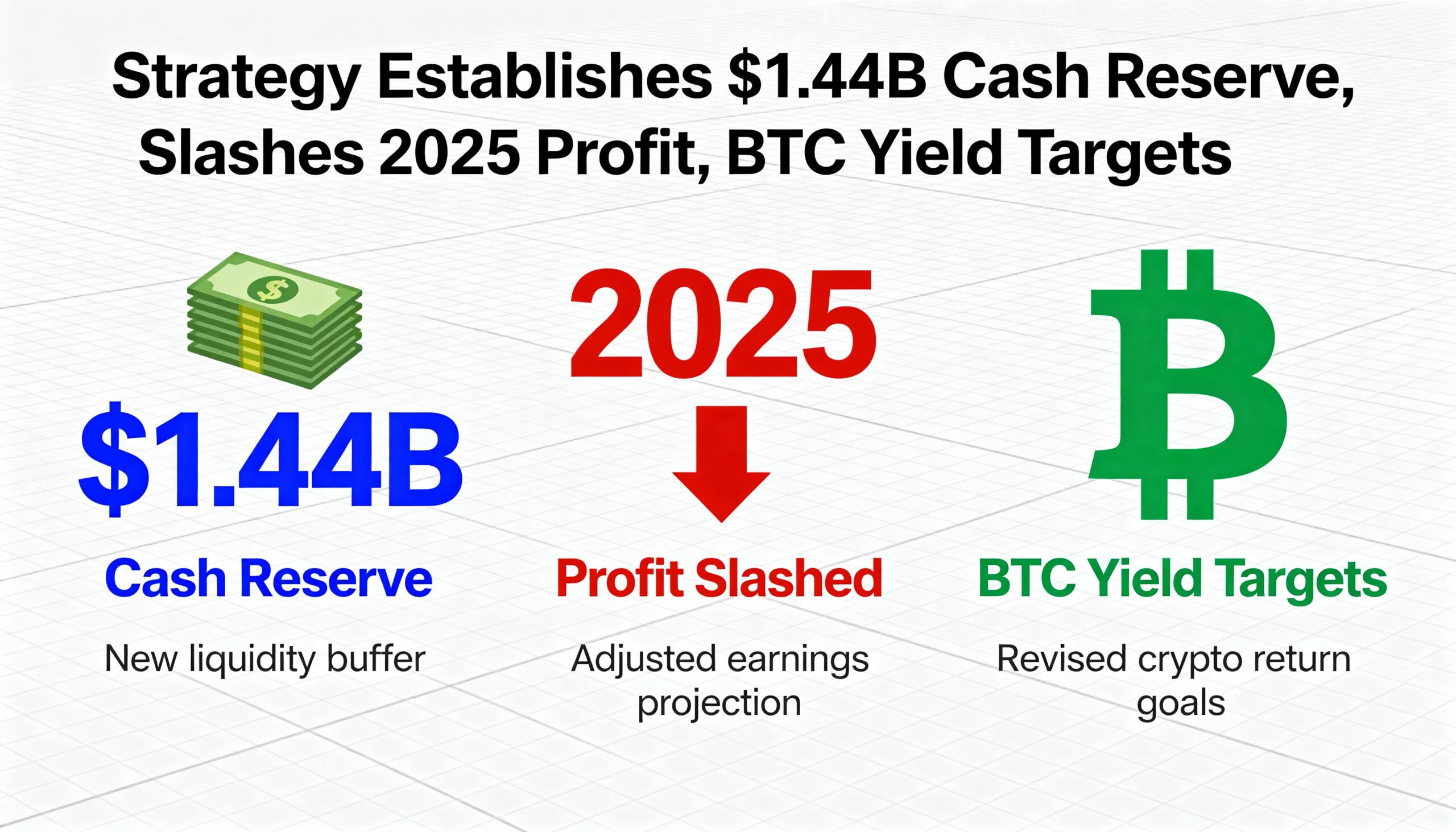

To address concerns over dividend funding for its preferred stock, the company announced the creation of a $1.44 billion U.S. dollar reserve on Monday. Funded primarily through the sale of common stock, the reserve is initially intended to cover twelve months of dividends, with plans to expand it to cover 24 months or more.

Amid a recent bitcoin decline—down 5% to $86,000 versus a year-end target of $150,000—Strategy revised its full-year guidance. Net income is now projected between a $5.5 billion loss and a $6.3 billion gain. Bitcoin yield targets were cut to 22%-26% from 30%, while full-year bitcoin dollar gains are now expected to range from $8.4 billion to $12.8 billion, down from $20 billion previously.

The company also made a small bitcoin purchase of 130 coins for $11.7 million at an average price of $89,860 per coin, bringing total holdings to 650,000 BTC, acquired for $48.38 billion, or $74,436 per coin. The purchase was largely funded through last week’s sale of 8.214 million common shares, which raised $1.478 billion, most of which went to the new reserve.

MSTR shares were down 4.4% in premarket trading, mirroring bitcoin’s overnight decline.