Strategy (MSTR), the world’s largest publicly traded holder of bitcoin, increased both its bitcoin holdings and cash reserves in the final days of 2025 and early 2026, funding the additions through sales of common stock.

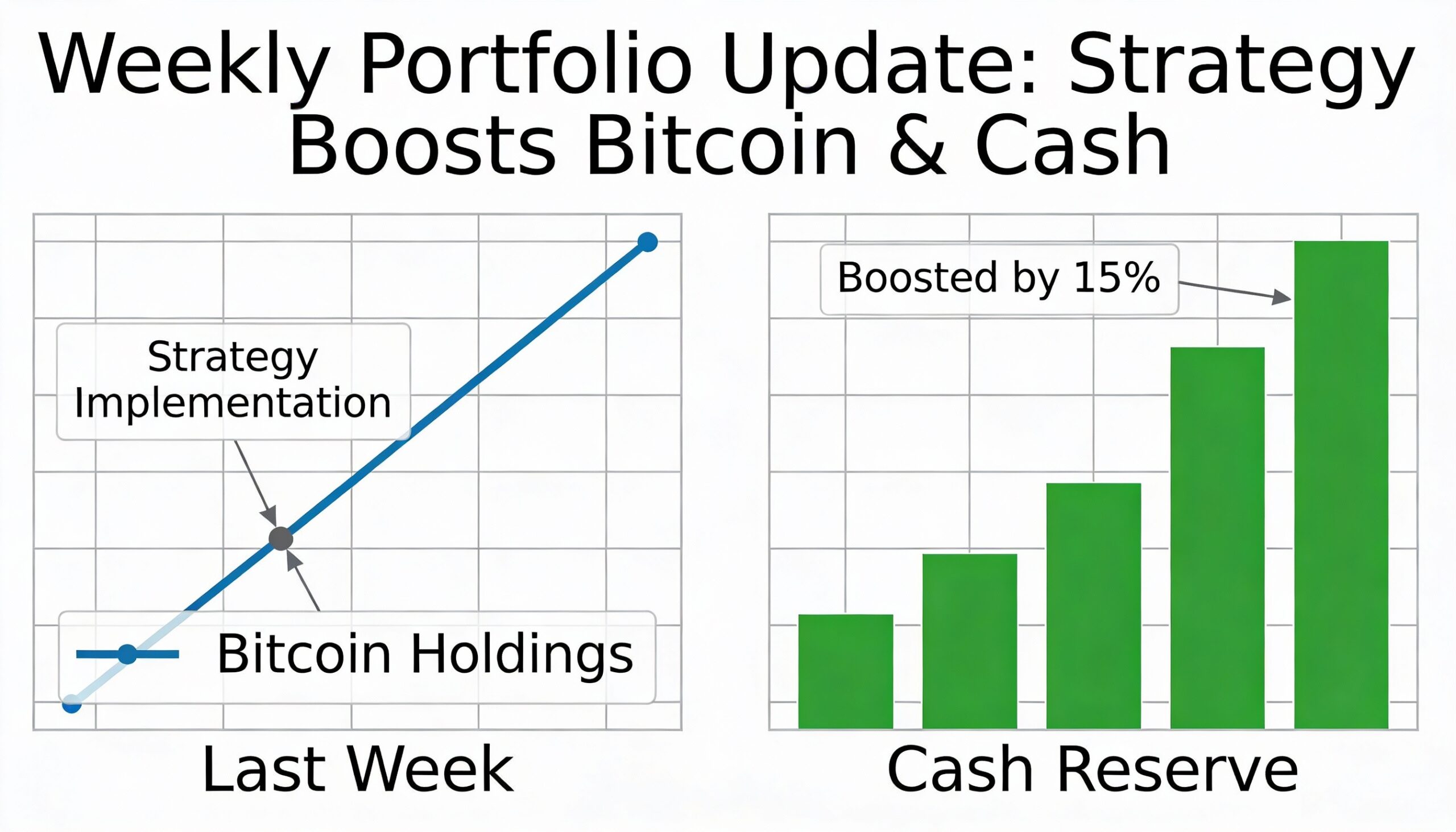

Led by Executive Chairman Michael Saylor, the company acquired 1,287 bitcoin for just over $116 million, paying an average price of roughly $90,000 per coin. Strategy now holds 673,783 bitcoin acquired for a total of $50.55 billion, implying an average purchase price of $75,026 per bitcoin.

During the same period, the company boosted its cash reserves by $62 million, lifting its total cash balance to $2.25 billion.

Strategy said the expanded cash position is intended to support dividend payments on its perpetual preferred equity. Based on current levels, the company has sufficient liquidity to cover approximately 32.5 months of dividend obligations, according to its dashboard.

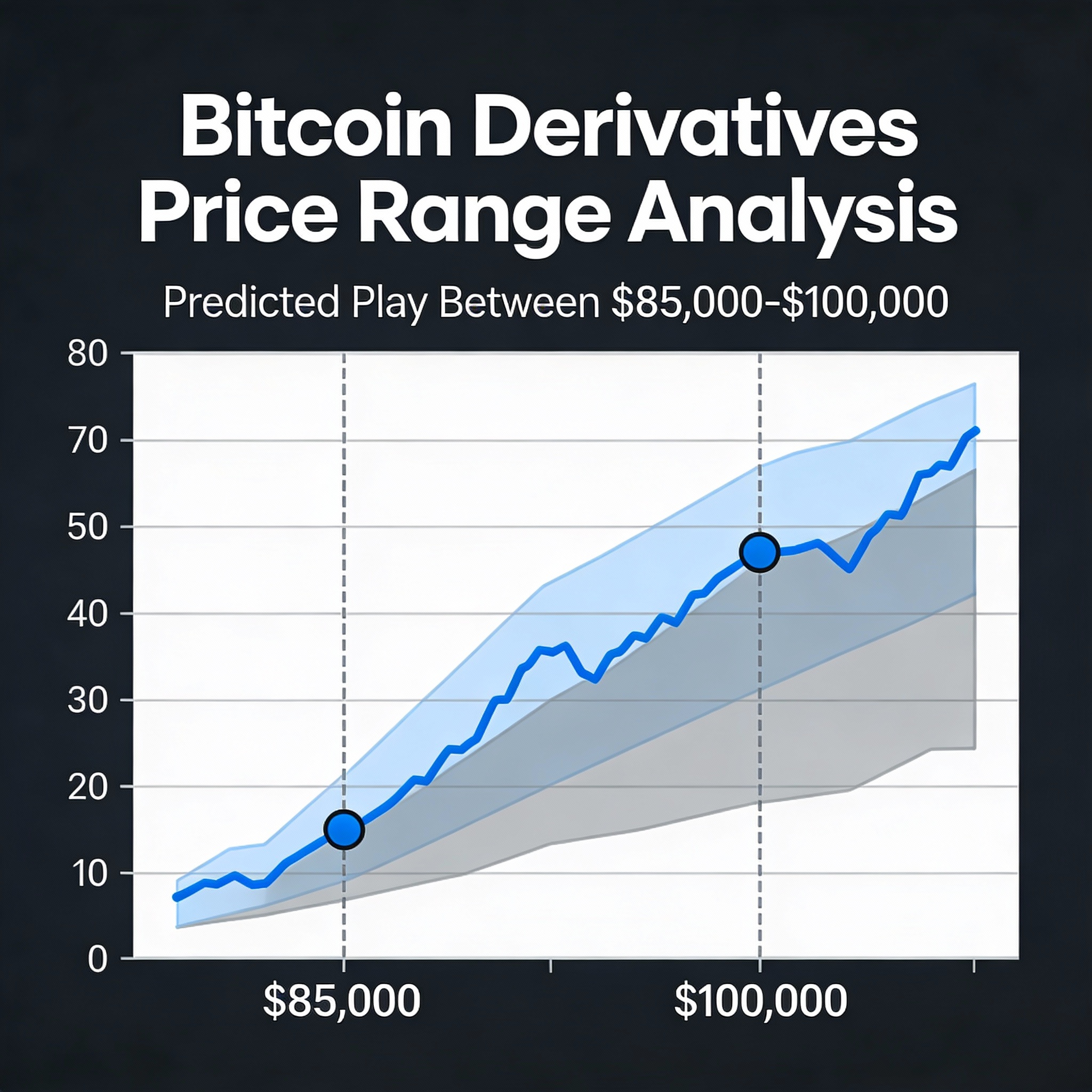

Alongside the balance sheet update, Strategy disclosed $17.44 billion in unrealized losses on its bitcoin holdings for the fourth quarter. The losses reflect bitcoin’s decline from around $120,000 at the start of October to roughly $88,000 by year-end.

Shares of Strategy rose 4.5% in premarket trading, tracking a weekend rebound in bitcoin prices to about $92,900.