Bitcoin treasury firm Strategy (MSTR) said it would remain solvent even if bitcoin were to collapse to $8,000, insisting it could still cover roughly $6 billion in net debt under such a scenario.

In a post on X, the company led by Michael Saylor stated: “Strategy can withstand a drawdown in BTC price to $8K and still have sufficient assets to fully cover our debt.”

Strategy currently holds 714,644 BTC — valued at about $49.3 billion at prevailing prices — making it the largest bitcoin holder among publicly traded companies. Since adopting bitcoin as its primary treasury reserve asset in 2020, the firm has steadily accumulated the cryptocurrency, often financing purchases through debt issuance.

The approach has been mirrored by other corporates, including Tokyo-listed Metaplanet, which has also turned to bitcoin-backed strategies. Strategy’s outstanding debt totals approximately $6 billion, equivalent to around 86,956 BTC at current prices — a fraction of its overall holdings.

While the debt-funded accumulation strategy drew praise during bitcoin’s rally to an October peak above $126,000, sentiment has shifted following the cryptocurrency’s retreat to near $60,000. A sustained downturn has fueled concerns that forced liquidations could weigh further on prices if heavily leveraged holders needed to raise cash.

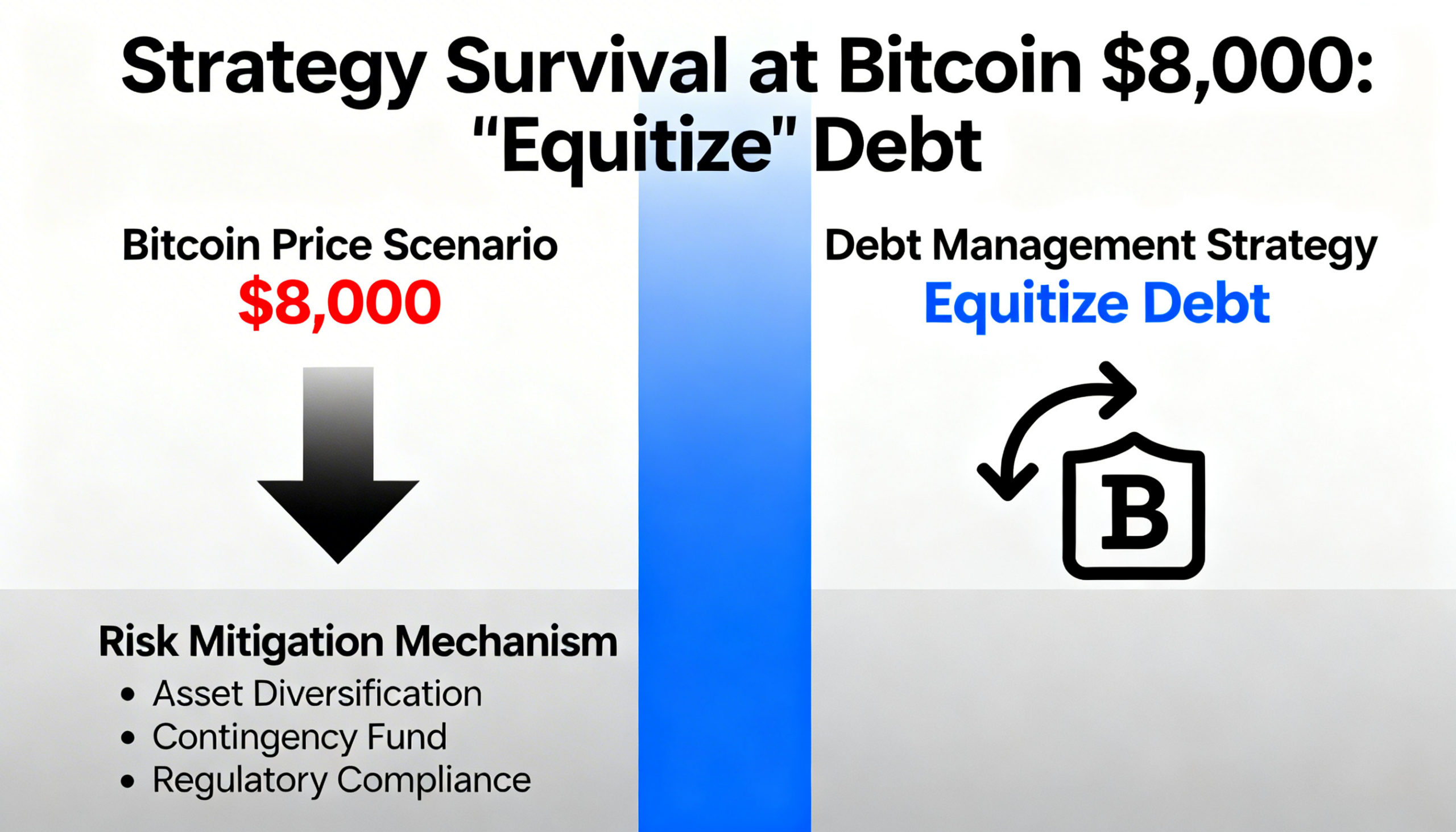

Strategy sought to calm those fears, arguing that even at $8,000 per bitcoin, the value of its holdings would still approximate $6 billion — theoretically enough to cover its net debt. The company also noted that its debt maturities are staggered between 2027 and 2032, reducing near-term refinancing pressure.

Additionally, Strategy said it intends to “equitize” portions of its existing convertible debt rather than issue new senior debt. Convertible notes allow lenders to exchange debt for equity if the company’s share price reaches predetermined levels, potentially easing balance sheet strain without increasing leverage.

Critics, however, question the optics of such a scenario. Pseudonymous macro investor Capitalists Exploits pointed out that Strategy reportedly spent about $54 billion acquiring its bitcoin trove, at an average cost near $76,000 per coin. A drop to $8,000 would imply roughly $48 billion in unrealized losses, significantly weakening the company’s balance sheet on paper — even if assets technically still covered outstanding debt.