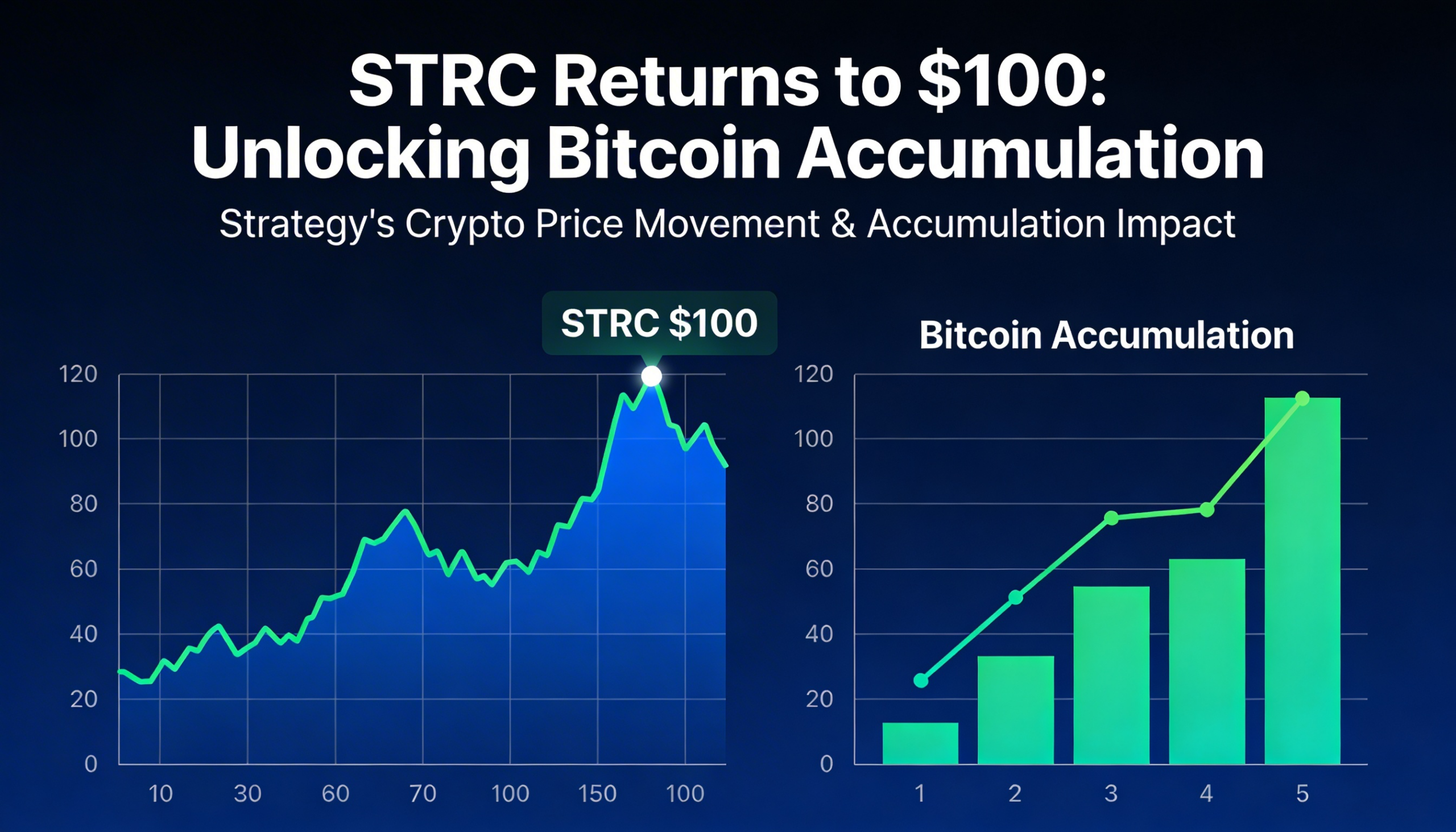

Stretch (STRC), the perpetual preferred security issued by Strategy (MSTR) — the largest corporate holder of bitcoin — climbed back to its $100 par value during Wednesday’s U.S. trading session, marking its first return to that level since mid-January.

A move back to par is significant because it allows the company to restart at-the-market (ATM) issuance of STRC, a mechanism Strategy has used to raise capital for additional bitcoin purchases. The security last traded at $100 on Jan. 16, when bitcoin was hovering near $97,000. As the cryptocurrency later slid to roughly $60,000 on Feb. 5, STRC fell as low as $93 before rebounding alongside the broader market.

Structured as a short-duration, high-yield credit instrument, STRC currently carries an 11.25% annual dividend paid monthly. To help stabilize trading around par and encourage investor participation, Strategy adjusts the dividend rate each month, most recently increasing it to the current 11.25% yield.

Meanwhile, Strategy’s common shares came under pressure, with MSTR declining 5% on Wednesday to close at $126, as bitcoin traded around $67,500.