Growing interest in lower strike options is pointing to increased demand for downside protection in bitcoin, following a sharp market correction.

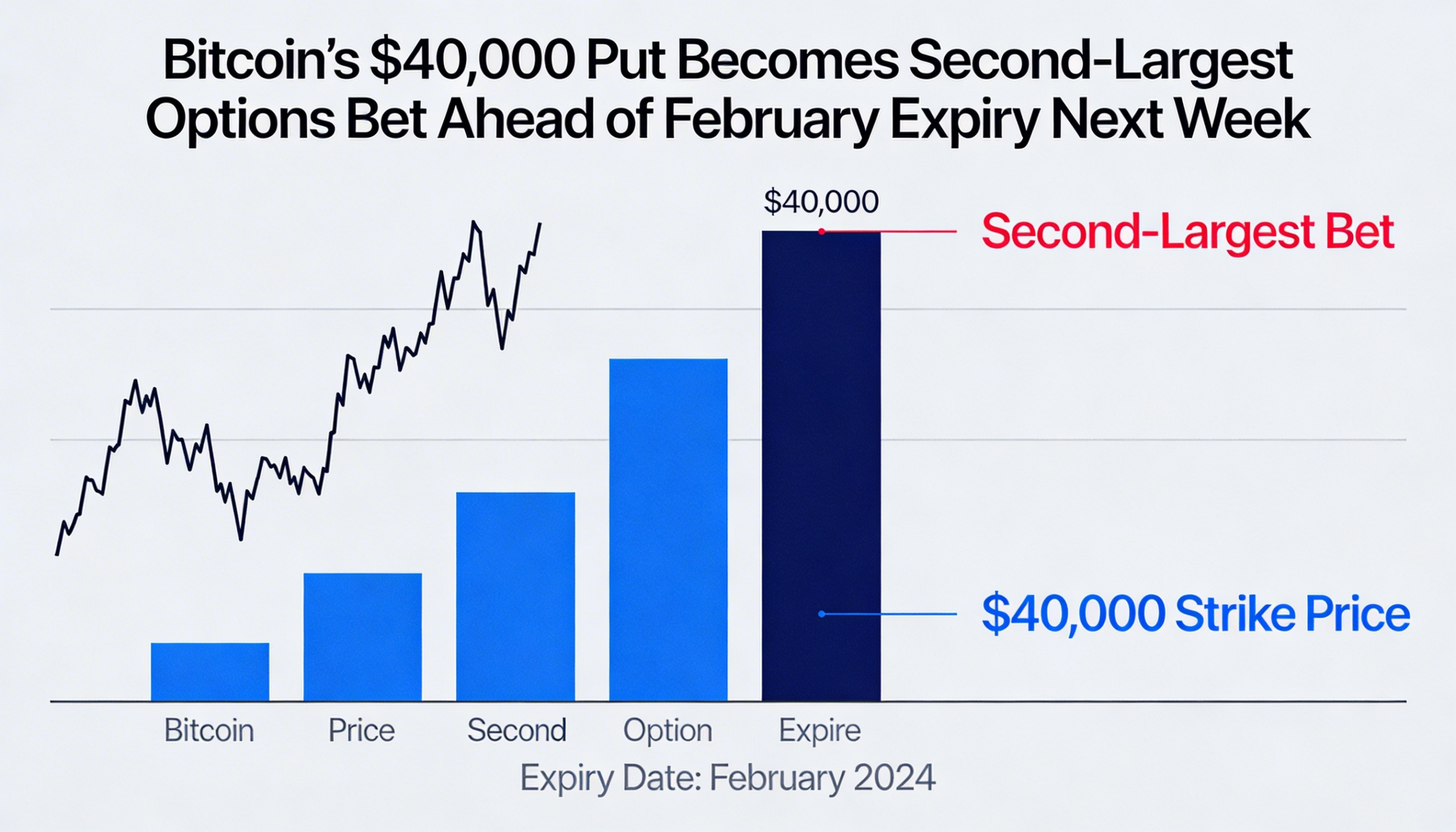

The $40,000 put option has become one of the most prominent positions ahead of the Feb. 27 expiry, signaling that traders are actively hedging against the risk of deeper losses after a bruising selloff. Put options give holders the right, but not the obligation, to sell bitcoin at a predetermined price before expiration, effectively serving as insurance if prices fall below the strike level.

The $40,000 strike now ranks as the second-largest by open interest, with approximately $490 million in notional value tied to that level. The concentration underscores appetite for protection against extreme downside scenarios. Bitcoin has fallen as much as 50% from its October peak and currently trades near $66,000, prompting a broad reshuffling of derivatives positioning as participants guard against further weakness.

According to data from Deribit, the Dubai-based options exchange owned by Coinbase, around $7.3 billion in bitcoin options notional value is set to expire at month-end.

At the same time, roughly $566 million in open interest is concentrated at the $75,000 strike, which also represents the so-called “max pain” level — the price at which the greatest number of options contracts expire worthless, thereby minimizing payouts to buyers. With spot prices trading below $75,000, a rally into expiry could help reduce losses for call sellers.

While call options still outnumber puts overall — 63,547 call contracts compared with 45,914 puts — positioning is not unequivocally bullish. A put-to-call ratio of 0.72 suggests upside exposure remains dominant, but the significant buildup of put open interest at lower strikes highlights clear demand for downside hedging.

In short, traders are maintaining exposure to a potential rebound while simultaneously bracing for the possibility of another sharp leg lower.