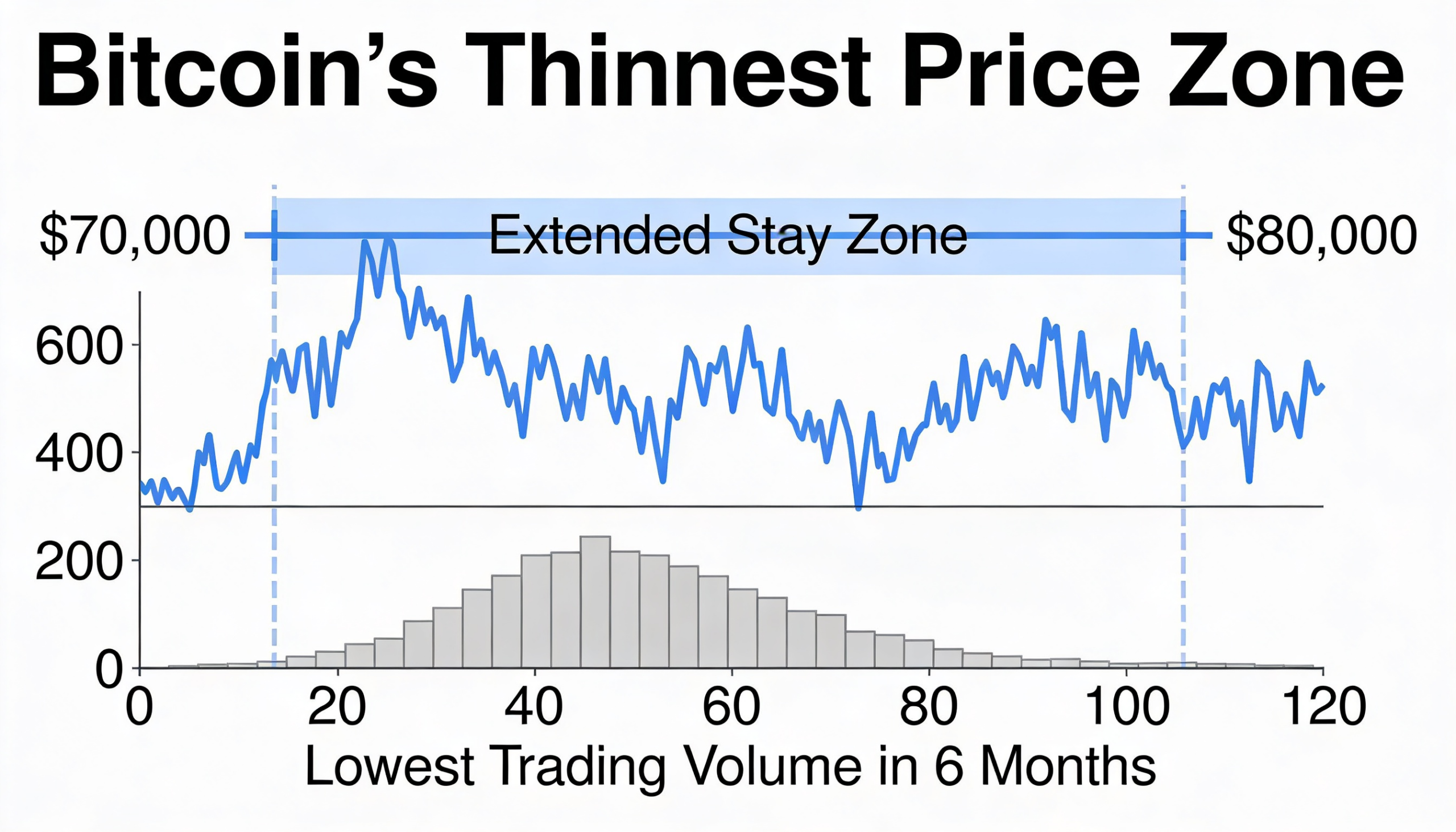

Since the weekend’s pullback, Bitcoin (BTC $68,419.02) has remained trapped between $70,000 and $79,999 for five straight days—a rare stretch for a range where the cryptocurrency has historically spent little time.

Bitcoin has spent roughly 35 days in this $10,000 band, making it one of the least established zones. The asset has typically moved quickly through these levels rather than forming strong support or resistance.

Extended time in a range allows positions to accumulate, which can later strengthen support. This suggests Bitcoin may consolidate here, or possibly retest the lower boundary, before building a more solid base.

During last April’s tariff-driven volatility, Bitcoin lingered below $80,000 for only a few weeks before rebounding. Similarly, when it hit a then all-time high near $73,000 in March 2024, it spent little time at those levels before retreating.

A dramatic example of rapid movement through this zone occurred in November 2024, after Donald Trump’s presidential election victory, when Bitcoin surged from roughly $68,000 to $100,000 in just weeks—leaving minimal consolidation between $70,000 and $80,000.

Corporate activity in this range has also been limited. Strategy (MSTR), the largest corporate Bitcoin holder, has bought in this bracket only once: on Nov. 11, 2024, it acquired 27,200 BTC for around $2 billion at an average price of $74,463.

Overall, the data points to structural thinness between $70,000 and $80,000, highlighting why this zone remains underdeveloped and susceptible to swift moves.