Strategy (MSTR) has returned to making sizable bitcoin purchases, using preferred share issuance to sidestep the limitations created by its sharply declining stock price.

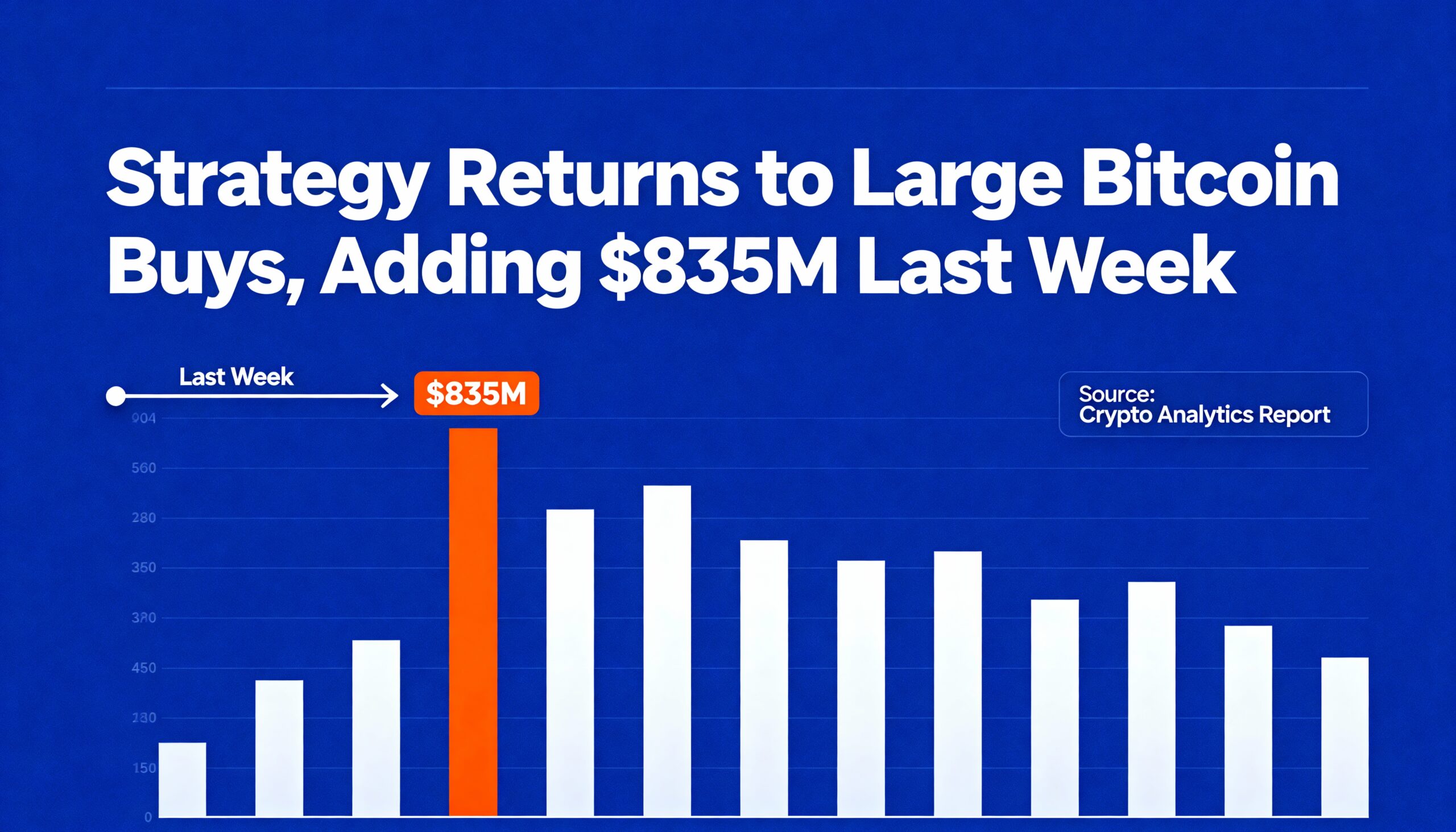

Large weekly acquisitions from Michael Saylor’s firm had become rare in recent months, but the company resumed aggressive buying last week, adding 8,178 BTC for $835.6 million at an average price of $102,171 per coin.

The purchase was funded primarily through Strategy’s newest preferred-share offering, STRE (Steam), which targeted European investors with high-yield terms and raised roughly $715 million earlier this month. An additional $131.4 million was secured through the company’s STRC (Stretch) preferred series, according to a Monday filing.

With the latest acquisition, Strategy now holds 649,870 BTC, accumulated at a total cost of $48.37 billion, or an average purchase price of $74,433.

Recent buys had been limited to smaller, routine additions as Strategy’s stock price plunged — falling 56% over the last four months — making common equity issuance too dilutive to existing shareholders. At Monday’s early trading price of $199, the company’s enterprise value is only marginally above the value of its bitcoin holdings.

Bitcoin itself traded around $94,500 on Monday, slightly lower than Friday’s levels