Japan is preparing to launch its first yen-backed stablecoin as the Bank of Japan (BOJ) signals a likely rate hike later this year—a move expected to increase demand for yen and yen-linked digital assets.

Tokyo fintech JPYC plans to register as a money transfer business this fall, paving the way for a JPY-pegged stablecoin that will trade at a 1:1 ratio with the yen. The Financial Services Agency (FSA) is expected to approve the project shortly. Stablecoins provide a regulated way to transfer capital for trading, remittances, and corporate payments while avoiding the volatility typical of other cryptocurrencies.

Monex Group is also exploring a JPY stablecoin for cross-border settlements and corporate use. Chairman Oki Matsumoto emphasized the importance: “Issuing stablecoins requires infrastructure and capital, but if we don’t handle them, we’ll be left behind.”

Market participants anticipate a BOJ rate hike in Q4, contrasting with a more dovish approach from the U.S. Federal Reserve. Rising rates and stronger inflation readings in Tokyo could boost the yen’s appeal and increase interest in JPY-backed stablecoins, similar to the surge seen in USD-pegged stablecoins during the 2022 rate cycle.

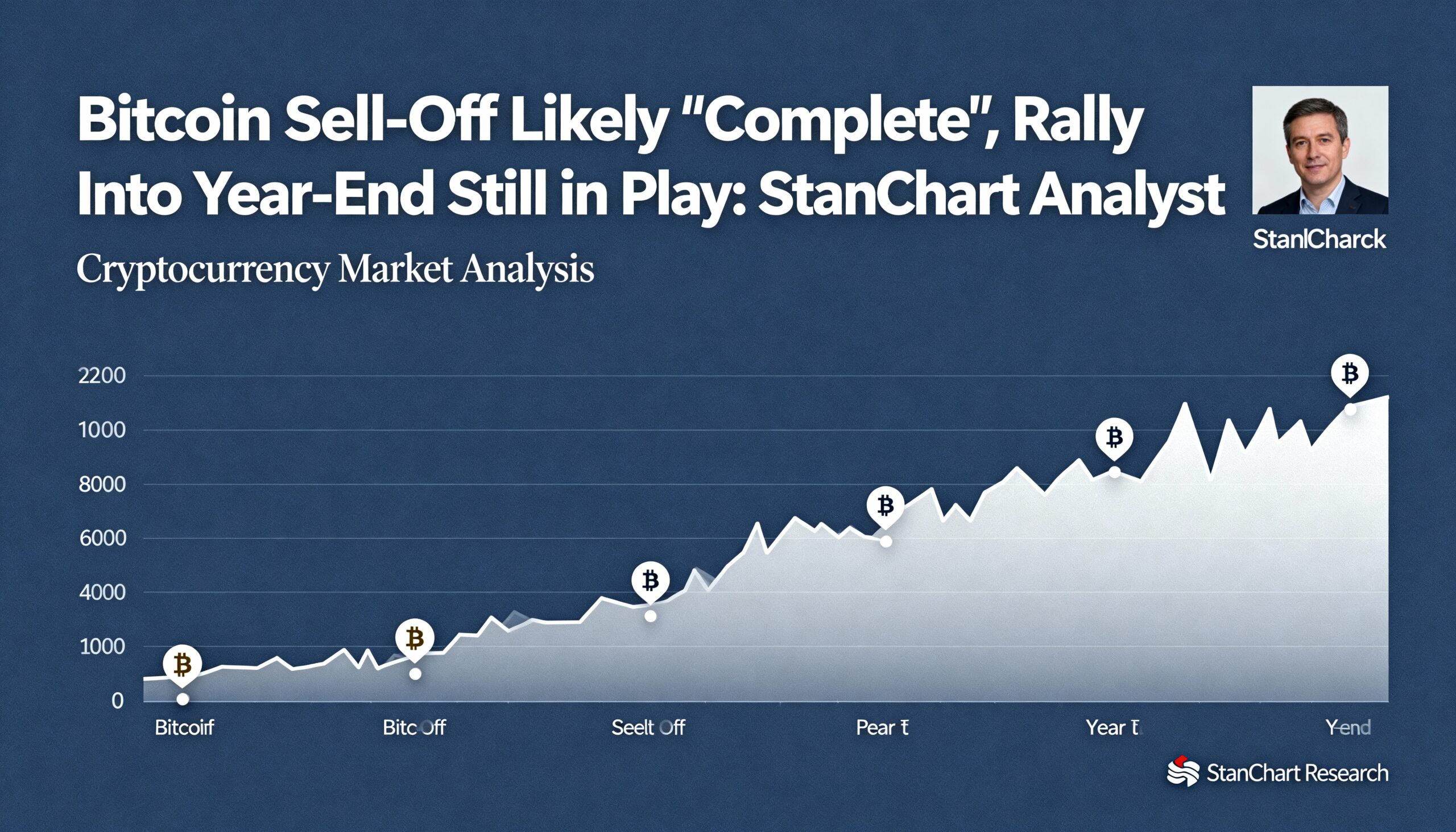

Japanese government bond yields are reaching multi-decade highs, with the 30-year JGB at over 3.2% and the 10-year at 1.64%. Narrowing yield differentials with U.S. bonds point to potential yen appreciation, which could affect BTC/JPY trading. Bitcoin priced in yen has dropped 8% this month, forming a double-top bearish pattern that technical analysis projects could fall further toward 14.92 million JPY.

The convergence of a JPY stablecoin launch with the expected BOJ rate hike positions Japan to expand adoption of digital yen assets, particularly for corporate treasuries, remittances, and trading activity.