Funding rates across major altcoins — including TON — have shifted back into positive territory, signaling a tentative revival in trader confidence even as overall market activity remains sluggish.

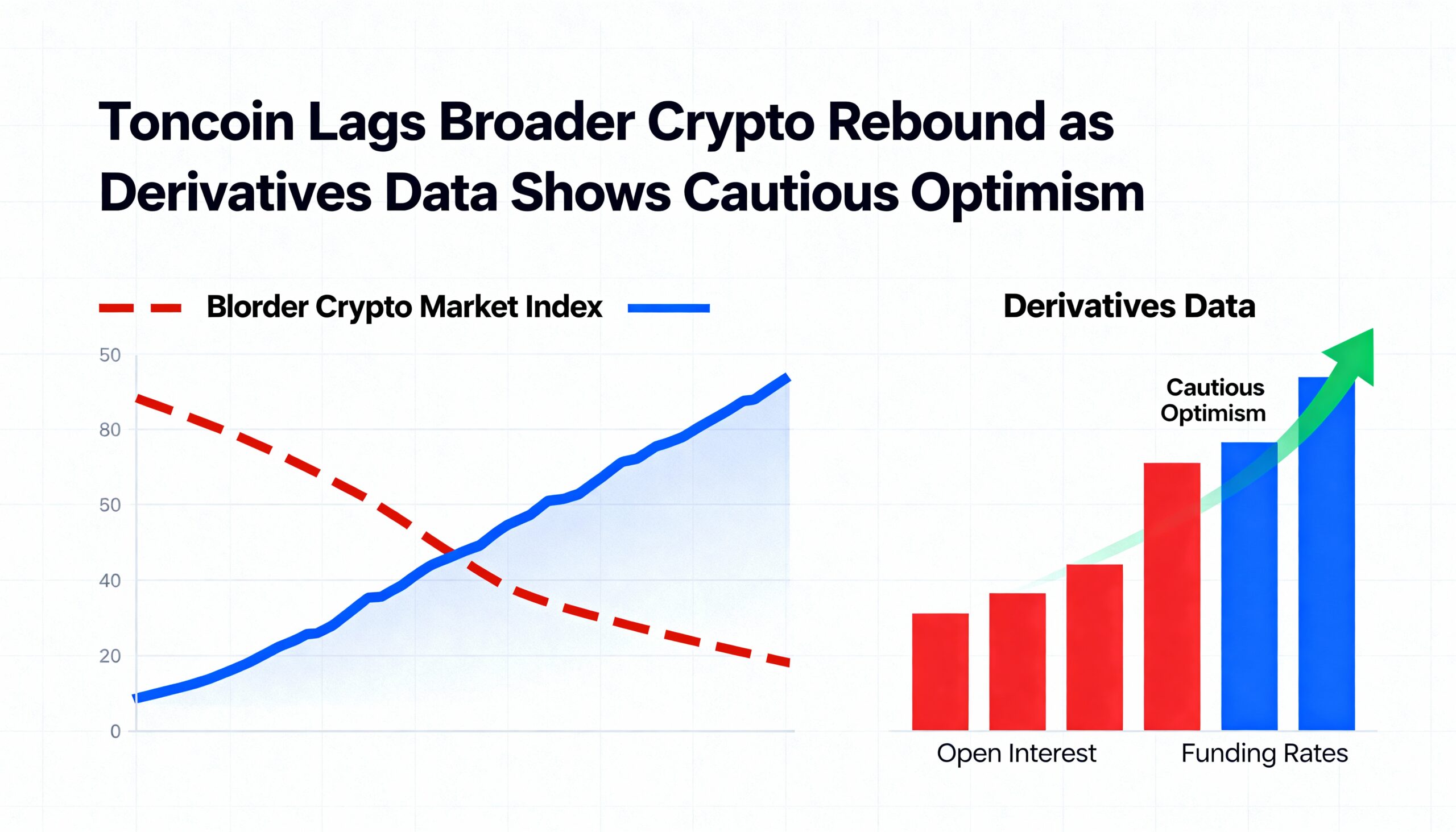

TON continues to trade around $1.60 following signs of improving sentiment across the digital asset landscape, according to a new derivatives report from Bybit and analytics firm Block Scholes. The report characterizes the market’s current phase as a “slow-but-steady” rebound led by bitcoin and ether, which have climbed above $91,000 and $3,000 after strong recent advances. The CoinDesk 20 (CD20) index has risen 6.8% over the past week, but TON has gained only 1.2% during the same period.

A key highlight of the report is the shift in altcoin perpetual swap funding rates. After a weekend marked by aggressive short positioning, these rates have flipped positive for several high-cap tokens, including TON. This indicates that traders are now paying to maintain long exposure — a traditional marker of improving sentiment, even if the optimism remains restrained.

Still, the broader participation picture is far from robust. Derivatives open interest and volumes remain notably below levels seen before the recent market downturn, and volatility indicators suggest traders no longer expect steep declines but have yet to meaningfully re-engage.

For TON specifically, the move in funding rates hints that some traders may believe a bottom is forming after extended downside pressure. Yet the report also notes that altcoins broadly lagged bitcoin and ether during the sell-off and have been slower to recover.

CoinDesk Research’s technical model shows support near $1.59, with a slight upward bias reinforcing the narrative of a gradual recovery. However, with thin participation and large holders still controlling significant supply, the token’s near-term direction remains tied to a broader revival in altcoin risk appetite.

Meanwhile, Telegram has activated its tokenized equity trading feature, allowing users to buy and sell U.S. stocks — including major names like Apple and Tesla — directly through TON-linked wallets.