Trump-Backed American Bitcoin Shares Tank Despite Crypto Rally

American Bitcoin Corp. (ABTC), the bitcoin mining and treasury firm founded by Eric Trump and Donald Trump Jr., saw its shares plunge up to 50% on Tuesday, marking another setback for Trump family crypto ventures. The drop came even as bitcoin climbed above $91,000 and most crypto-related stocks gained.

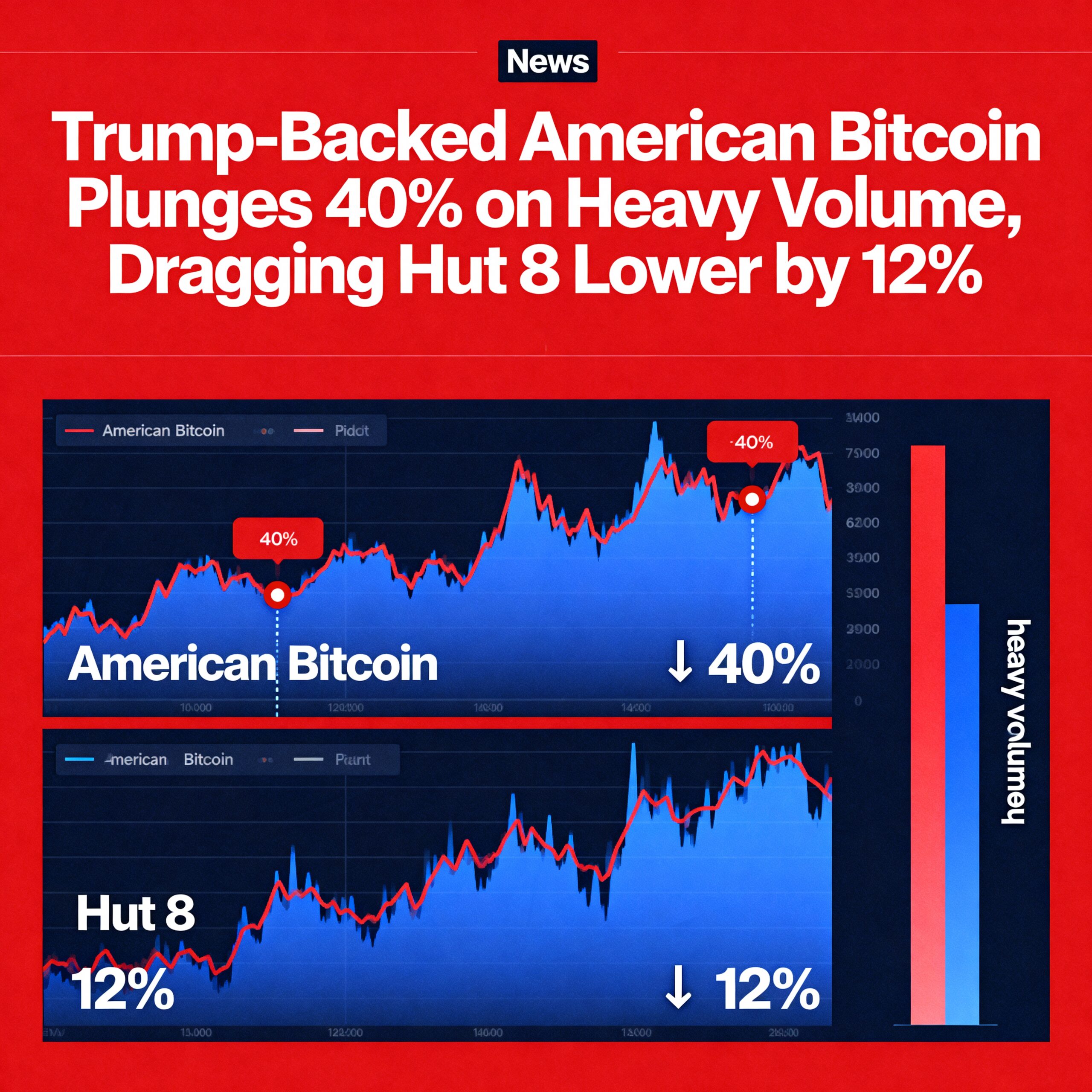

Trading volume surged to 55 million shares, far above the 3 million daily average, highlighting heavy selling pressure. While bitcoin recovered from a recent dip to nearly $92,000, ABTC remained down 40%, dragging Hut 8 (HUT)—which owns 80% of ABTC—down 12%. HUT had nearly tripled over the past six months, benefiting from miners pivoting into AI infrastructure.

Speculation pointed to insider selling, but SEC filings show a 180-day lockup for most historical ABTC holders until March 3, 2026, and a 12-month Investor Rights Agreement restricting sales through September 3, 2026, including Eric and Donald Trump Jr. Lockup details were shared on X by account RisenFit.

Addressing the sell-off on X, Eric Trump said:

“Pre-merger private placement shares unlocked today — early investors can cash in, causing volatility. Our fundamentals are strong: mining BTC at ~50% of spot with 56% gross margin in Q3. I’m holding all my ABTC shares — fully committed to leading the industry.”

ABTC went public via a reverse merger with Gryphon Digital in September 2025, trading near $14 at the time. Following Tuesday’s decline, shares hover just above $2.

The drop adds to a string of Trump-linked crypto disappointments. WLFI token is down 70% from its peak, TRUMP and MELANIA meme coins have collapsed, and Trump Media (DJT)—with a significant bitcoin treasury—has fallen about 75% year-to-date.