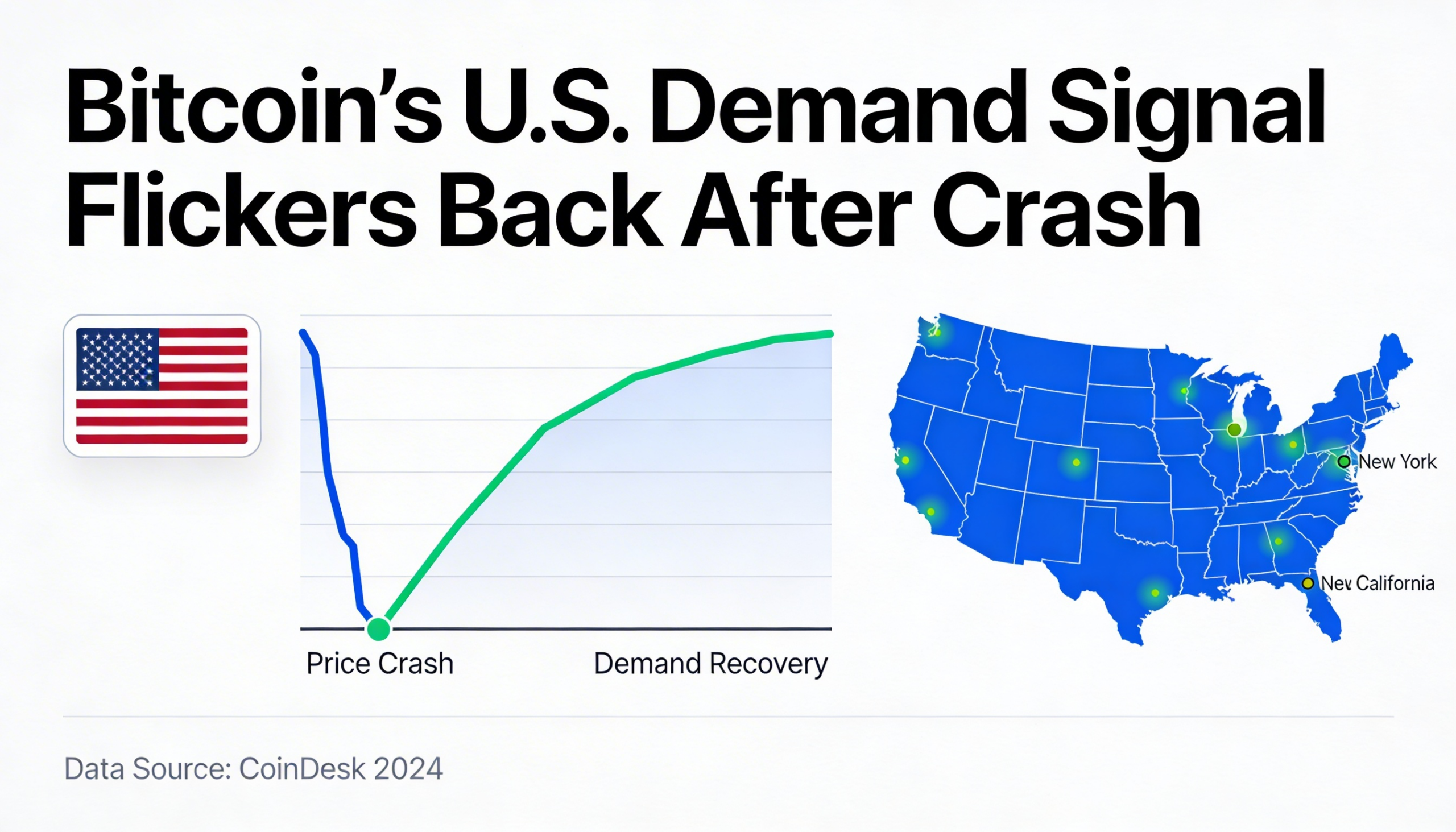

Bitcoin’s rebound from last week’s sharp selloff is being accompanied by early signs that U.S. buyers are returning, though the signal remains tentative rather than decisive.

After sliding toward $60,000 during its steepest decline since the 2022 FTX collapse, bitcoin (BTC) has staged a strong recovery. Alongside the price bounce, the Coinbase Bitcoin Premium Index — a closely watched measure of U.S. demand — has improved markedly.

The index, which tracks the price difference between bitcoin on Coinbase and the broader global average, climbed from roughly -0.22% at the height of the downturn to about -0.05% by Tuesday. While still negative, the move suggests that selling pressure from U.S.-based investors has eased and that some buyers stepped in near the lows.

Coinbase is widely regarded as a proxy for institutional and dollar-based flows. When the premium sinks deep into negative territory, it often signals aggressive U.S. selling or a retreat to the sidelines. The rebound toward neutral levels indicates renewed interest, particularly as the market stabilized following forced liquidations.

However, the indicator has not yet crossed into positive territory — a threshold that historically aligns with sustained accumulation and a broader return of risk appetite among U.S. funds. As it stands, the shift appears to reflect selective dip-buying rather than a full-fledged change in sentiment.

Other market data supports that restrained interpretation. Research from Kaiko shows that aggregate trading volumes across major centralized exchanges remain well below their late-2025 highs. Spot volumes, in particular, continue to trend lower overall, pointing to a gradual thinning of participation rather than a surge in fresh demand.

In low-liquidity conditions, price rebounds can be sharp once selling exhausts itself. But without consistent follow-through from buyers, those gains can prove fragile.

Bitcoin is currently hovering just below $70,000, up more than 15% from its recent intraday bottom, though it remains down over 10% for the week