Negative Funding Rates Signal Temporary Bearish Overload as Bitcoin Hovers Near $94K

Bitcoin’s (BTC) perpetual futures funding rate turned negative for the first time in 2025, according to data from Glassnode. The brief dip occurred as Bitcoin’s price retested the $92,500 level on Thursday before rebounding above $94,000, reflecting a tug-of-war between bears and bulls.

What Negative Funding Rates Indicate

Perpetual futures funding rates act as a gauge of market sentiment, balancing the price between futures and spot markets. Negative rates occur when short sellers dominate, forcing them to pay funding fees to long positions. While this often reflects bearish sentiment, it can also hint at an overcrowded short trade that may unwind.

On Thursday, the funding rate dropped to -0.001%. Though not as extreme as historic instances like March 2020’s plunge to -0.309%, the negative rate signals heightened bearish bets, which often precede short squeezes or local bottoms.

Navigating Bitcoin’s Range

Since mid-November, Bitcoin has been locked in a range between $90,000 and $100,000. This volatility has created a psychological seesaw: optimism spikes near $100,000, while fear intensifies closer to $90,000. Thursday’s funding rate shift underscores the market’s tendency to overreact at key levels.

The Role of Derivatives in Volatility

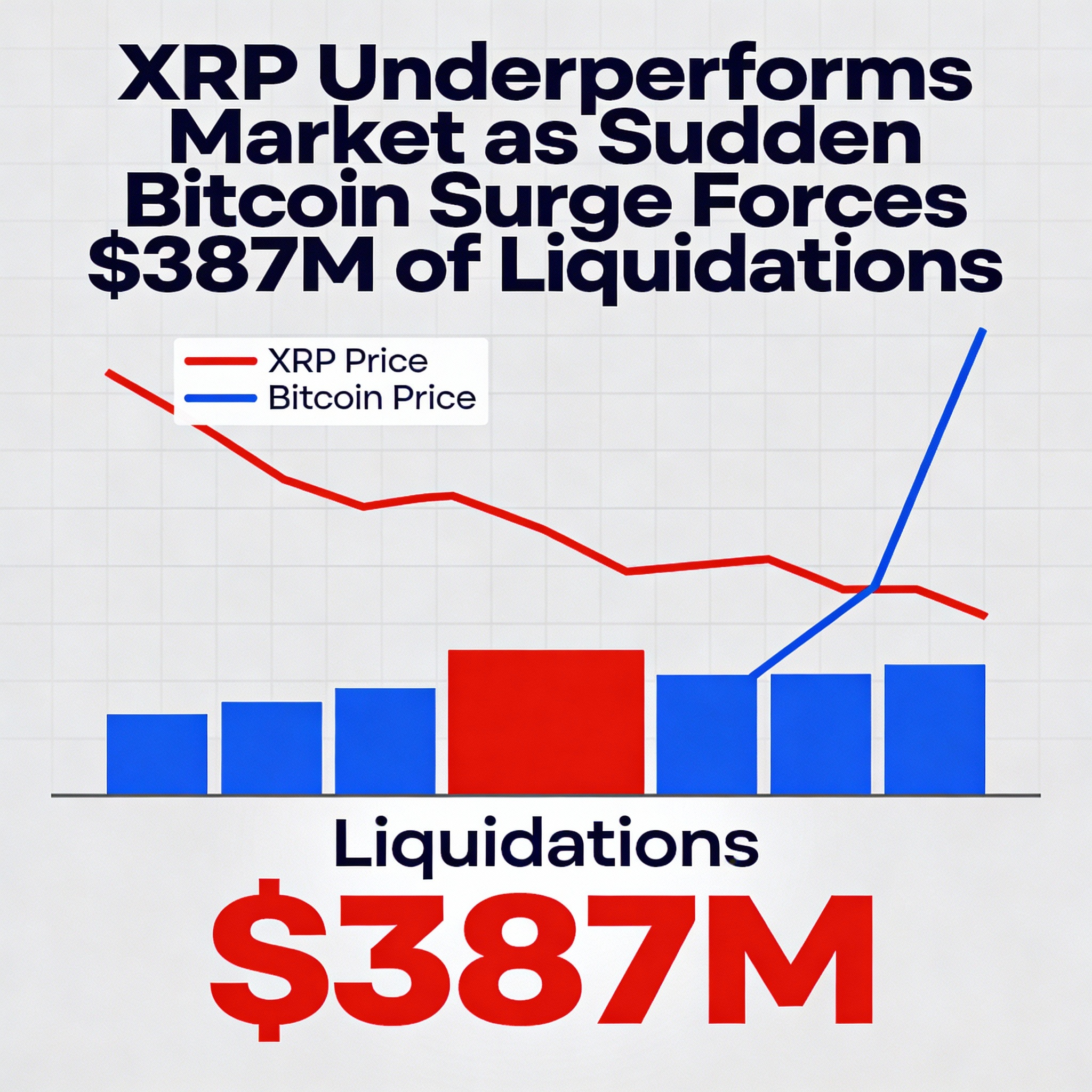

Although perpetual futures represent a small fraction of Bitcoin’s market capitalization, their impact on price movements is substantial due to leverage. Negative funding rates suggest excessive bearish leverage, which can lead to short liquidations that drive prices higher.

Glassnode’s data shows that Thursday’s rate dip coincided with a flush of bearish positions, temporarily relieving downward pressure on Bitcoin and aiding its recovery above $94,000.

Looking Back to Look Ahead

Historical trends suggest that funding rate dips often align with local bottoms, especially during bull markets. In 2023 and 2024, negative rates appeared during sharp corrections, only to be followed by rapid price recoveries.

However, negative funding alone isn’t a guaranteed reversal signal. It should be assessed alongside other indicators, such as order book activity, trading volume, and macroeconomic developments.

What’s Next for Bitcoin?

As Bitcoin consolidates in its current range, traders remain alert to potential breakouts or breakdowns. If the $90,000 level is breached, more bearish momentum could build, targeting lower supports. Conversely, if Bitcoin sustains a recovery, it may reattempt the $100,000 psychological resistance.

For now, the brief turn to negative funding serves as a reminder of the precarious balance between bullish and bearish forces in Bitcoin’s derivatives market.