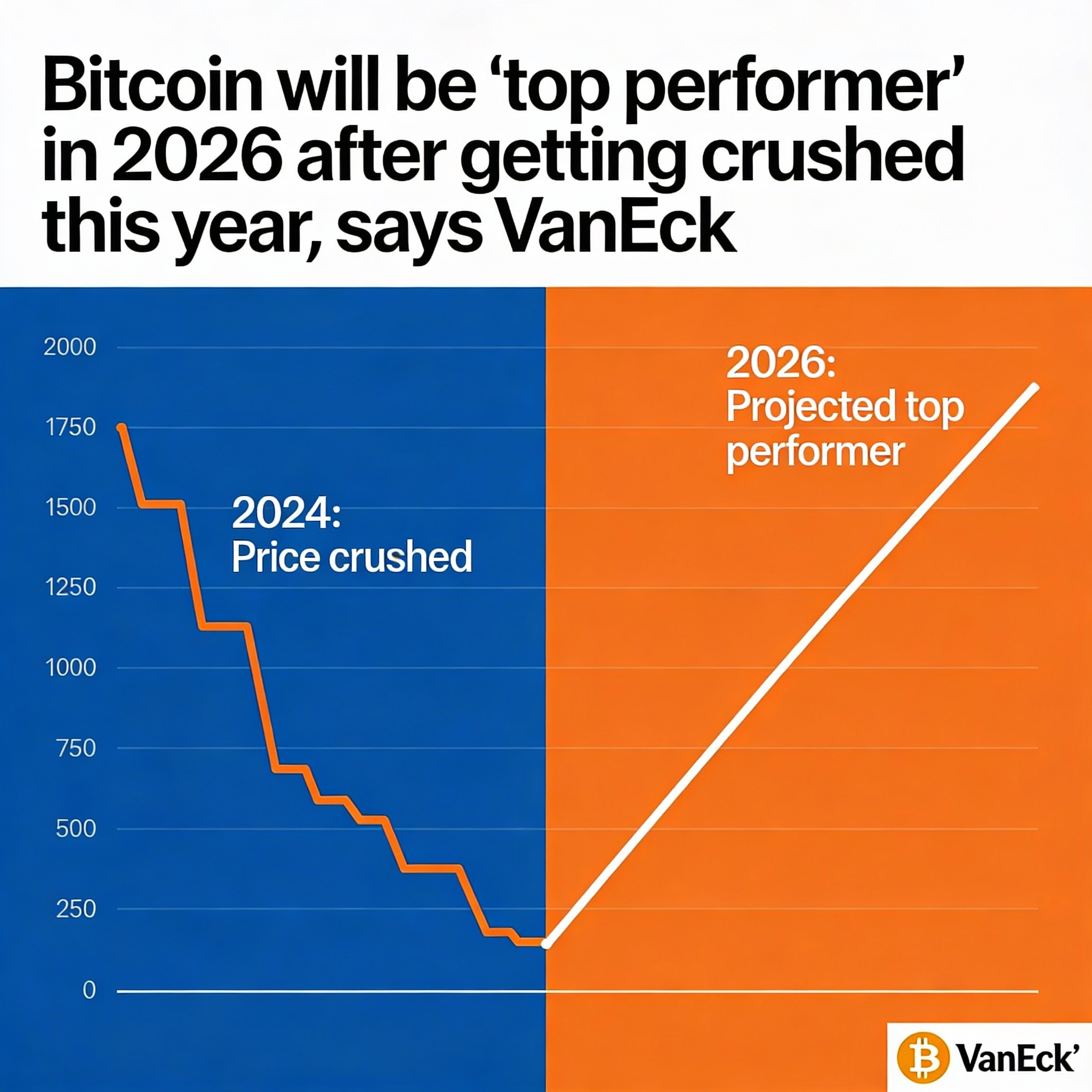

VanEck Predicts Bitcoin Could Lead in 2026 After Weak 2025

Bitcoin (BTC $88,347) has lagged behind both gold and the tech-heavy Nasdaq 100 in 2025, falling short of expectations that it would benefit from fiat currency devaluation.

However, VanEck sees potential for a major rebound next year.

“Bitcoin is trailing the Nasdaq 100 Index by roughly 50% year-to-date, and that gap positions it to be a top performer in 2026,” said David Schassler, head of multi-asset solutions at VanEck, in the firm’s recently published 2026 outlook.

While this year’s weakness reflects tighter liquidity and reduced risk appetite, Schassler maintains that Bitcoin’s core thesis remains intact. “As currency debasement accelerates and liquidity returns, BTC has historically responded sharply,” he said.

VanEck’s broader outlook is anchored in three forces: monetary debasement, technological transformation, and the rise of hard assets. Schassler argues that funding future liabilities and political goals will increasingly rely on money printing, pushing investors toward scarce stores of value like gold and Bitcoin.

Gold, which has gained over 70% this year and currently trades around $4,492 per ounce, is expected to climb further, potentially reaching $5,000 in 2026.

At the same time, natural resources are quietly entering a bull market, fueled by AI, energy transitions, robotics, and re-industrialization. These “old-world assets,” according to Schassler, are laying the groundwork for the new economy.