Technical analysts say XRP is entering a tightening range, with price coiling between firm support at $1.39 and near-term resistance at $1.44. A decisive reclaim of the upper boundary could trigger a push toward $1.50 and potentially $1.62.

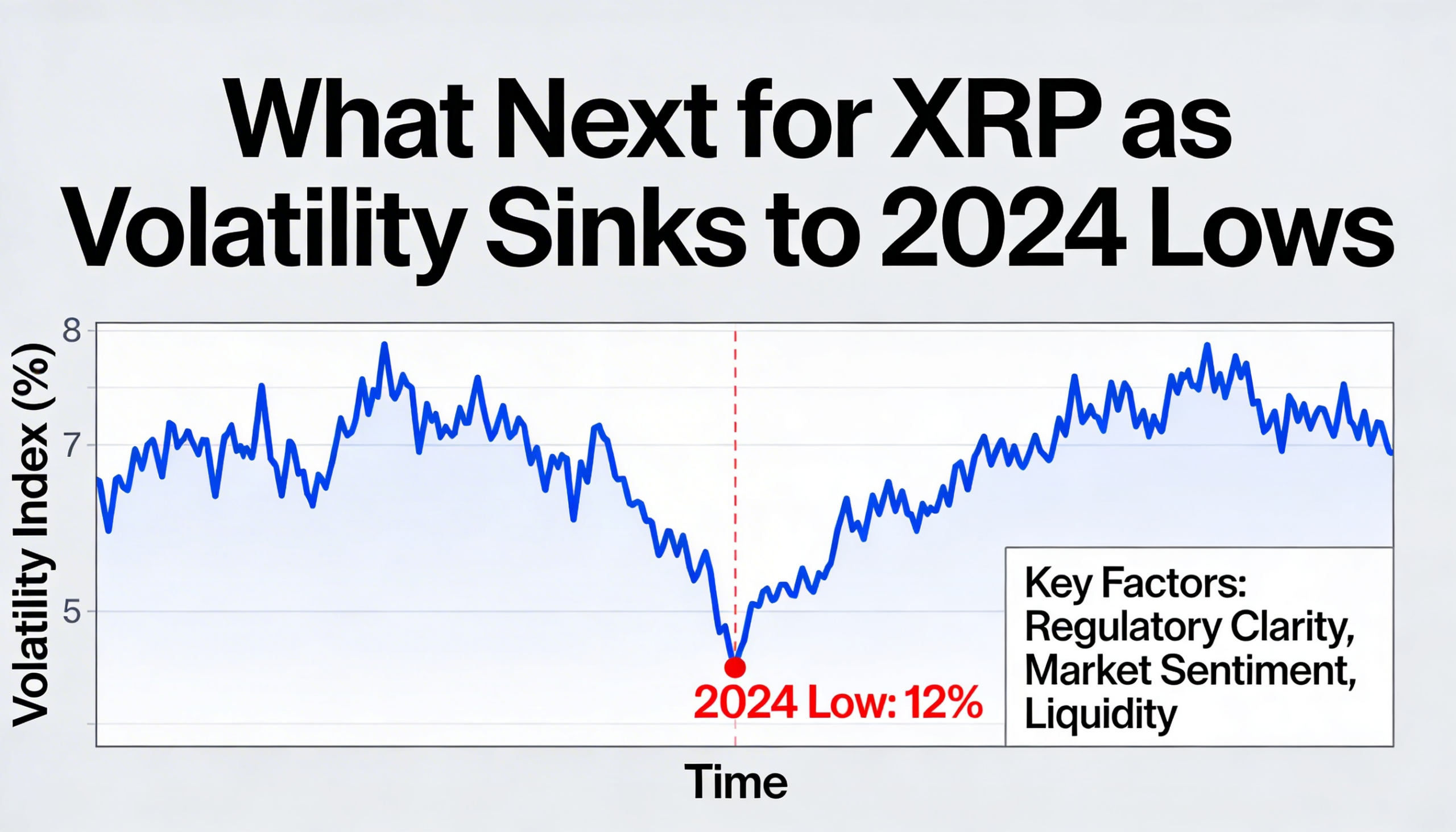

XRP was trading around $1.42 as volatility eased to levels last seen ahead of a notable 2024 rally, raising the possibility that the broader downtrend is beginning to stabilize.

Cooling volatility, shifting tone

The token remains roughly 61% below its all-time high during the current period of market stress. However, recent price action suggests selling momentum is fading. Instead of steep declines, XRP has transitioned into consolidation, with smaller intraday fluctuations replacing sharp directional moves.

Historical volatility has dropped to 96, matching readings recorded in June 2024 — a period that marked the end of a prior correction before a rally into November. The similarity has prompted some market participants to suggest XRP may be forming another base.

Comparisons have also been drawn to earlier cycle patterns, including the prolonged sideways phase that preceded the 2017 breakout.

Recent price behavior

- XRP slipped 0.14% to $1.42

- Support near $1.39 was tested and held

- Volume surged about 94% above average during the dip

- The rebound stalled in the $1.428–$1.431 zone

Technical setup

The key development occurred when XRP tested $1.3915 on elevated volume before finding buyers. The subsequent bounce retraced 38.2% of the prior decline, but momentum weakened near $1.44, which aligns with the daily pivot and continues to cap upside attempts.

While the structure remains cautious below the $1.44–$1.45 band, the successful defense of $1.39 indicates that bearish pressure may be diminishing. At the same time, declining volume during consolidation suggests compression rather than renewed distribution.

Levels to watch

Traders characterize the current structure as a volatility squeeze — a tightening range that often precedes a larger directional move.

- A sustained break above $1.44 could open a path toward $1.50 and $1.62.

- A breakdown below $1.39 would shift focus to $1.35 as the next support level.

With volatility hovering near prior cycle lows, the next major move may hinge less on immediate direction and more on how long the current compression phase persists before expansion resumes.