Bitcoin Trades Below Power Law: Is Mean Reversion Coming?

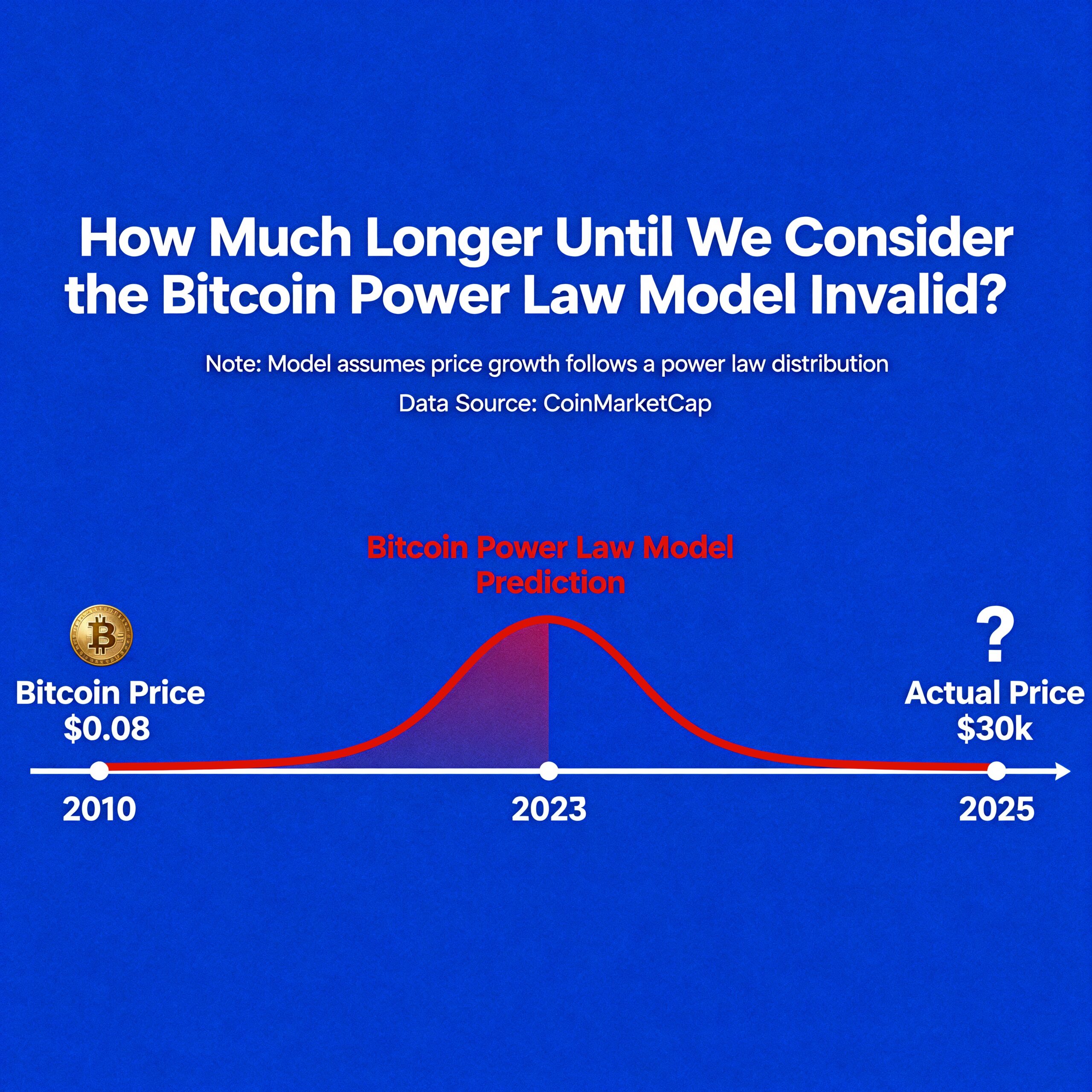

Bitcoin is now trading significantly below the Power Law model, prompting questions about whether a mean reversion is imminent or if the model itself is being challenged.

Historically, every long-term bitcoin valuation framework eventually breaks down. Yet the Power Law has held up better than most this cycle. In previous bull and bear markets, bitcoin frequently overshot or fell below the model, but in the current cycle, prices have largely tracked its trajectory.

The Power Law provides a mathematical perspective on long-term trends, showing that bitcoin’s performance follows a logarithmic power law distribution. While useful for structural insights, it is backward-looking and does not guarantee future predictive accuracy.

Currently, bitcoin trades below $90,000—around 32% under the model’s $118,000 value. This is the largest divergence since the August 2024 yen carry trade unwind, which saw a 35% deviation and took three months to recover.

In comparison, models like PlanB’s Stock-to-Flow have long been invalid, now implying unrealistically high prices above $1 million per bitcoin.

The pressing question for the market: will bitcoin revert to the Power Law trend, or could it drop further, putting yet another major model to the test?