Even after the latest market pullback, XRP remains one of the crypto sector’s strongest performers, posting an 89% gain over the past year.

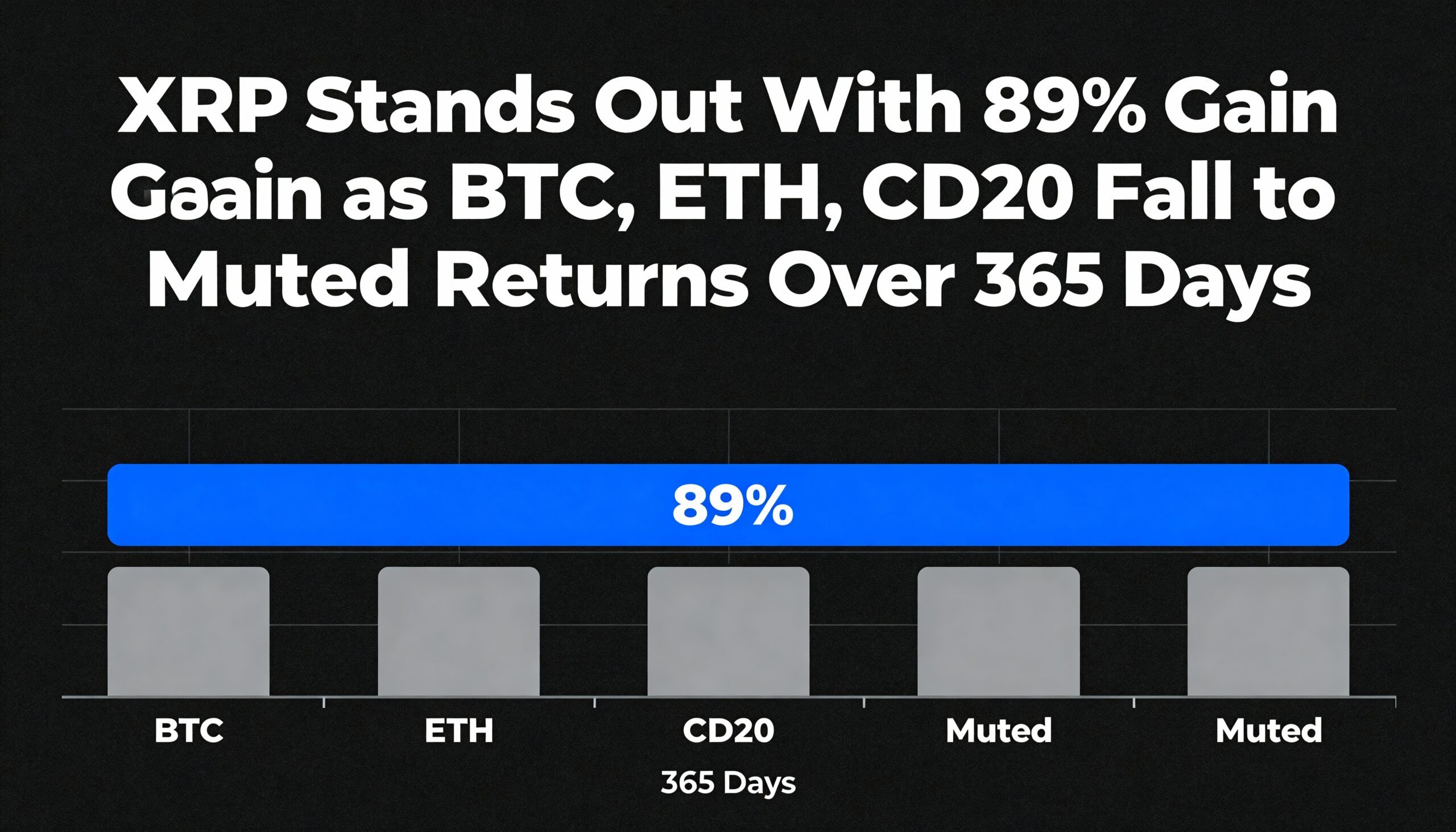

The recent downturn has pushed bitcoin (BTC), ether (ETH), and several major CoinDesk indices into weak or negative territory over a 365-day period. XRP is the only large-cap token that has managed to avoid this slide. As of Sunday, XRP’s 89% annual increase far exceeds the modest 3.6% returns seen in both bitcoin and the CoinDesk 20 (CD20) Index.

Only a handful of benchmarks posted gains at all. The CoinDesk 5 Index (CD5) added just above 2%, while ether climbed a marginal 2%. Other major crypto assets saw far sharper declines: solana (SOL) and cardano (ADA) each plunged more than 36%. The CoinDesk Meme Index suffered the steepest loss, collapsing 78% as speculative assets bore the brunt of the sell-off.

XRP also stands alone as the only major token that remains in positive territory for the year to date.

Its resilience is noteworthy considering XRP still trades 36% below the all-time high above $3.60 reached four months ago. Bitcoin, similarly, has dropped 24% since hitting its $126,000 peak in early October.

A series of catalysts help explain XRP’s exceptional relative performance. The conclusion of the SEC’s long-running case against Ripple — the company that uses XRP for cross-border settlement — removed one of the biggest obstacles to U.S. adoption. The ruling paved the way for increased institutional involvement and marked a turning point for XRP’s regulatory clarity.

Ripple’s recent technological and ecosystem advances have also boosted confidence. The introduction of the XRPL EVM sidechain and the rapid growth of Ripple’s RLUSD stablecoin, which reached a $1 billion market cap within a year of its December 2024 launch, have expanded XRP’s utility into the DeFi space.

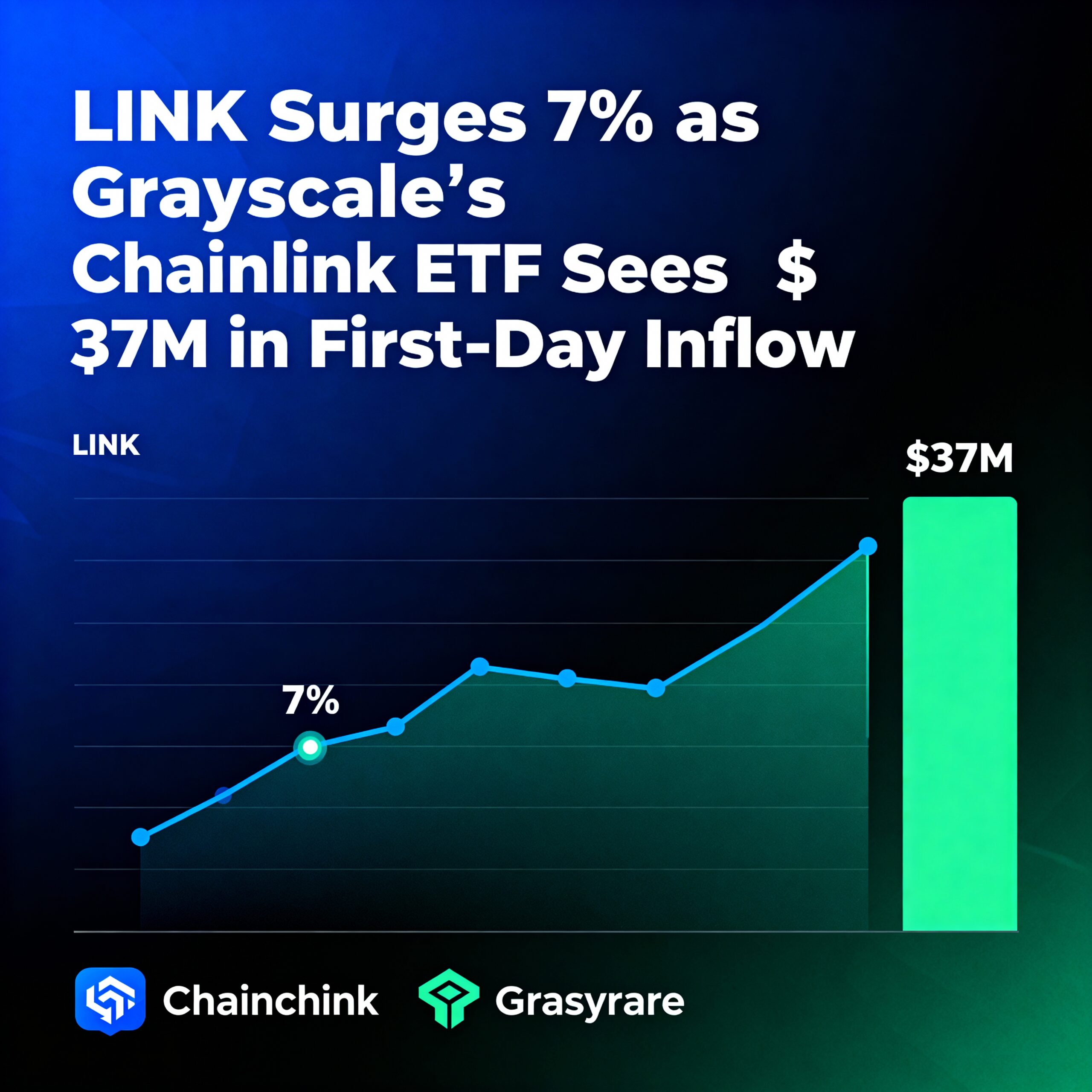

Momentum has also been supported by Ripple’s global partnerships, particularly across the Middle East, and its application for a U.S. banking license. This broader growth story culminated last week with the launch of Canary Capital’s spot XRP ETF in the U.S., which reported the highest first-day trading volume of any ETF released this year.

Industry leaders see substantial demand ahead. “It would be an enormous product — interest in XRP is extremely high,” Bitwise CEO Hunter Horsley said in an interview with CoinDesk TV. Horsley noted that trillions of dollars still sit in traditional financial systems, and more of that capital is gradually moving on-chain. ETFs often represent the first entry point for many institutions exploring new digital assets. “Once investors can gain exposure to XRP through an ETF, it becomes a highly useful and attractive instrument,” he added.

But XRP’s strong performance has come with significant volatility. Its 365-day annualized volatility stands at 91%, more than double bitcoin’s 44%. Only cardano (100.55%) and the CoinDesk Meme Index (115.85%) exhibit greater turbulence.

Still, analysts say this volatility may begin to ease if institutional participation continues to grow and more XRP-linked investment products secure approval, helping anchor the asset with steadier long-term capital