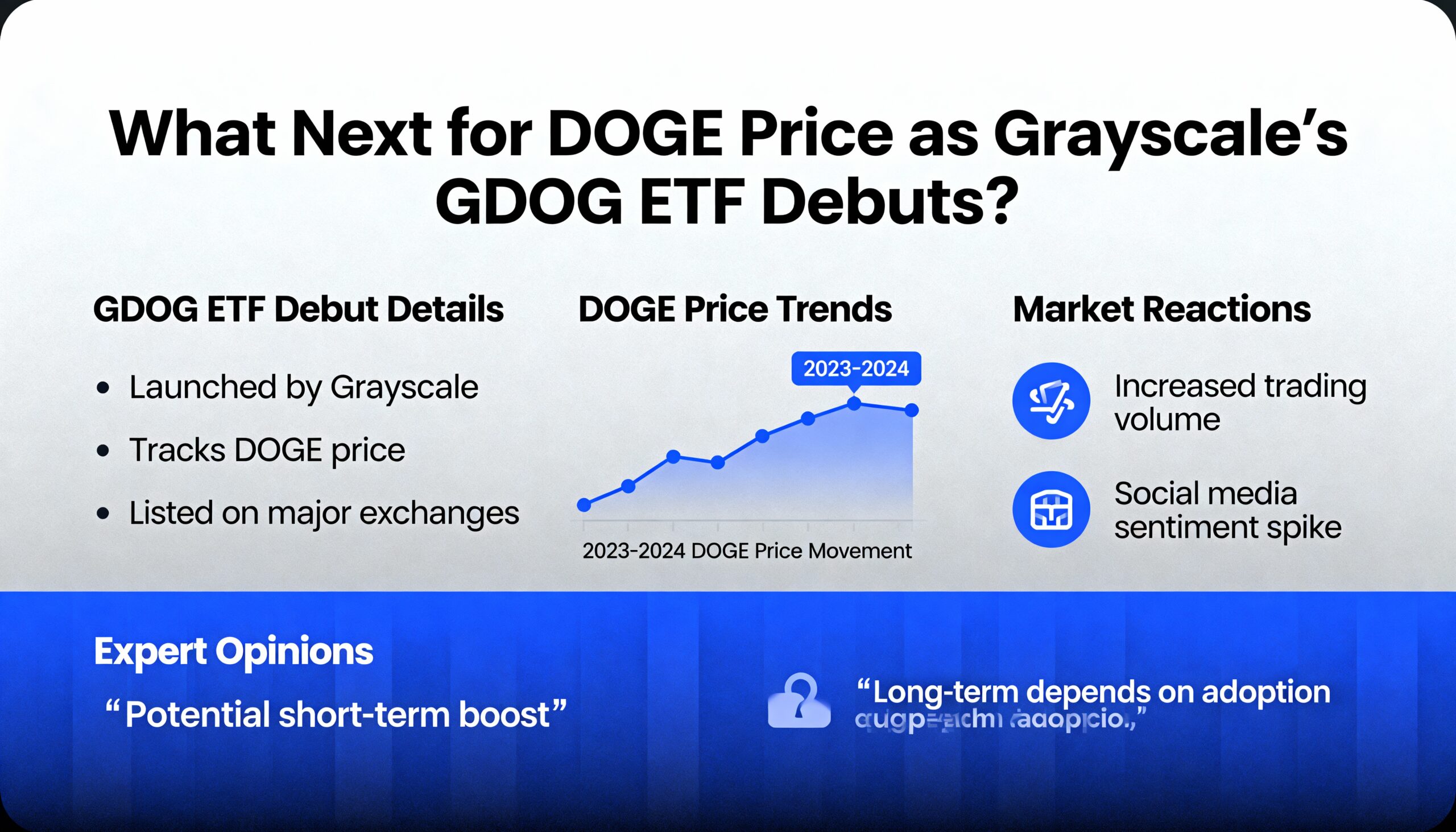

Dogecoin Retreats as Grayscale GDOG ETF Fails to Spark Breakout

Dogecoin (DOGE) pulled back after early-session gains as Grayscale’s DOGE ETF (GDOG) debut on the NYSE failed to overcome selling pressure and strong resistance. While the ETF expands institutional access, DOGE faces ongoing structural weakness.

Whale selling remains a key headwind. Wallets holding 10–100 million DOGE sold nearly 7 billion tokens from September 19 to November 23, creating a significant supply overhang and limiting upside momentum despite growing institutional infrastructure.

DOGE remains range-bound between $0.144 and $0.1495, with repeated rejections at the upper level reinforcing a neutral-to-bearish trend. Support at $0.144 has held, but weak volume during recovery attempts signals hesitant buying.

On November 24, DOGE traded between $0.1449 and $0.1495, closing at $0.1456 for a 1.4% decline. Despite early-session volume spikes, technical pressures continue to dominate, leaving DOGE vulnerable to further downside.