XRP Steadies at $2.63 as On-Chain Data Indicate Mounting Accumulation Pressure

Market Overview

XRP edged 0.89% higher to $2.63 on Tuesday, buoyed by a 26% jump in trading volume above weekly averages — a sign of growing trader engagement and institutional positioning ahead of a potential breakout. The move unfolded against a backdrop of continued consolidation across crypto markets, as investors await macro and technical catalysts for the next decisive move.

Fresh on-chain metrics added to the optimistic tone, revealing a 3.36% decline in exchange reserves since early October — a trend historically linked to long-term accumulation and reduced sell-side supply.

Price Performance

During the session, XRP oscillated within a tight $0.087 range, moving between $2.568 and $2.655. The token carved a sequence of higher lows but continued to face stiff resistance near $2.70.

Volume spiked to roughly 101.6 million tokens during an afternoon breakout attempt around 16:00 UTC, showing strong market participation but limited follow-through above the ceiling.

A late-session dip briefly dragged prices below $2.635 support to $2.632 before recovering modestly, underscoring the current balance between bullish and bearish forces.

Technical Setup

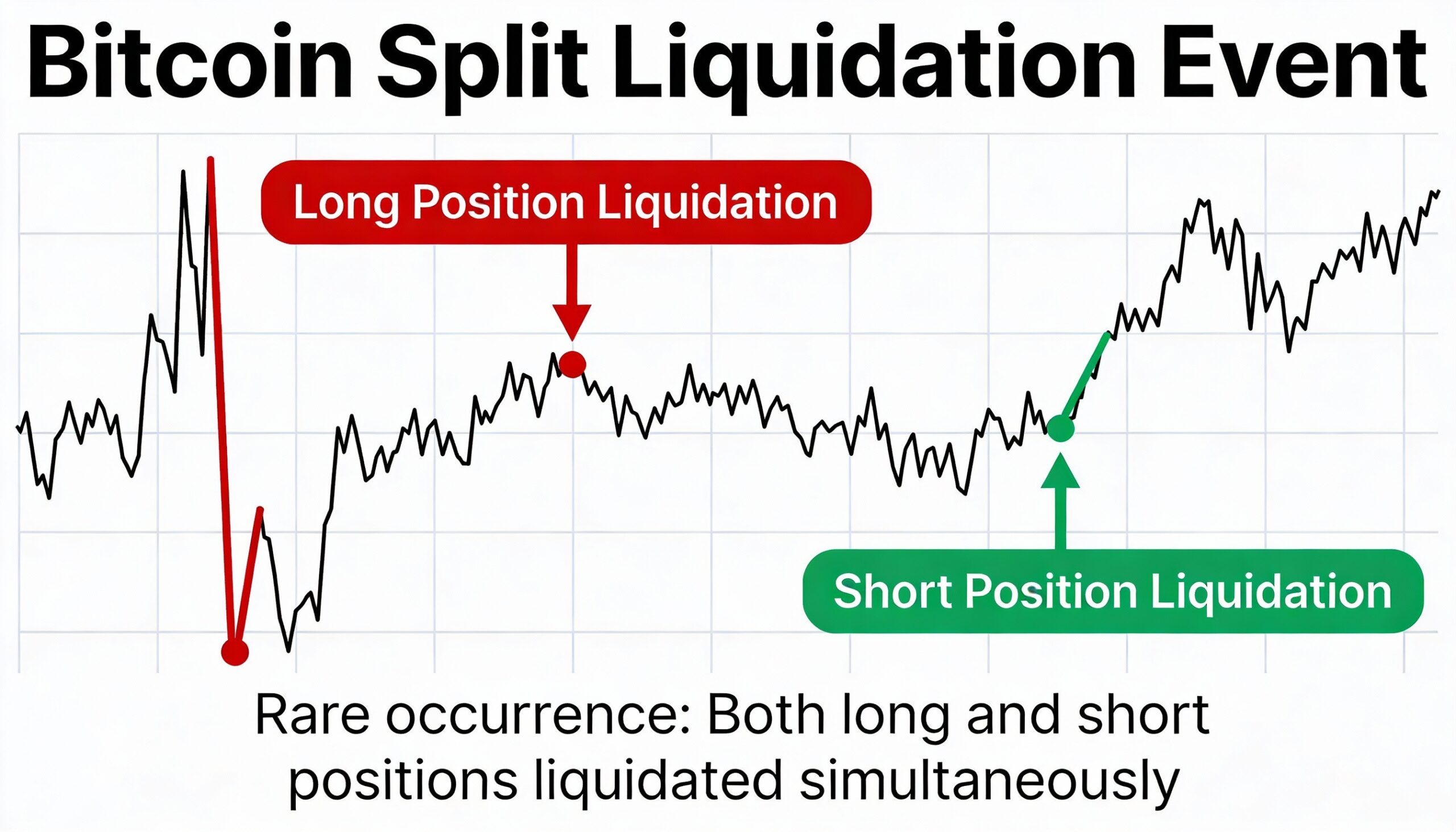

XRP’s short-term structure reflects sideways consolidation, bounded by support around $2.614 and resistance at $2.70. Rising volume supports a gradual accumulation phase, though the recent minor breach below $2.635 signals potential near-term fragility.

Momentum indicators are mixed — RSI remains neutral, while MACD is yet to confirm a breakout bias — implying that the market is coiling within a compression range that often precedes sharp directional moves.

Trading Outlook

Market participants should watch the $2.61–$2.63 zone closely in the coming sessions. Sustained defense of this region, combined with increasing volume, could confirm accumulation and pave the way for a breakout above $2.70.

Failure to maintain support may trigger a retest of $2.60 or $2.55, though the broader setup — including declining exchange reserves and strengthening volume — continues to favor a bullish resolution once momentum returns.