XRP, Dogecoin (DOGE), and Cardano (ADA) all experienced dramatic declines, each falling by over 25% and wiping out gains from December. This marked a return to the price levels seen before the U.S. election in early November. The sharp drop comes on the heels of the U.S. imposing new tariffs on Canada and Mexico over the weekend, sparking concerns of a full-scale global trade war that weighed heavily on investor sentiment.

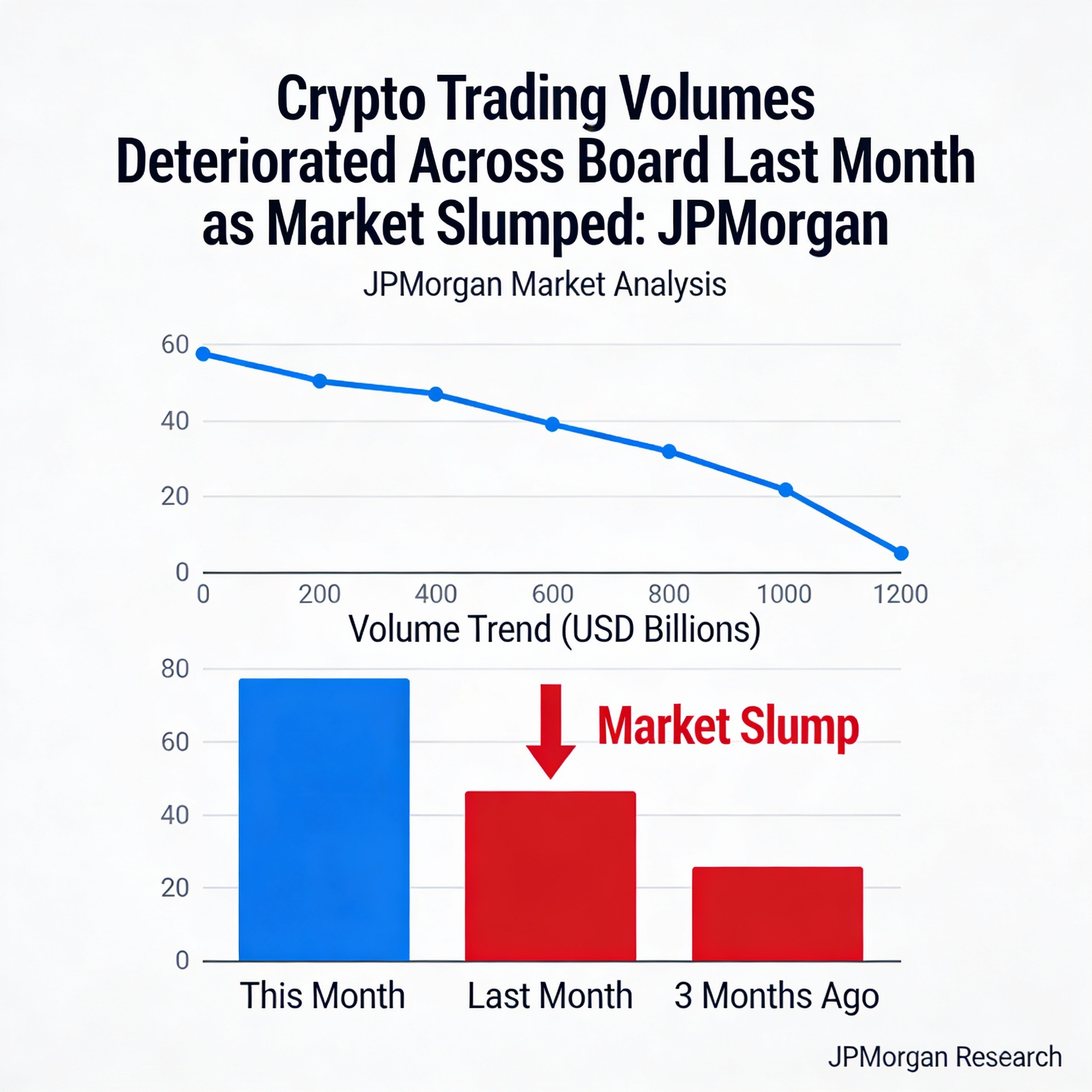

In the last 24 hours, a number of leading cryptocurrencies took a hit, with XRP, DOGE, and ADA seeing more than 25% losses. Bitcoin (BTC) also fell 6%, contributing to an overall market capitalization drop of 12%, marking the steepest decline in over a year. The CoinDesk 20 Index (CD20) lost 10%, further signaling widespread losses across the digital asset space. These developments are a reflection of the growing fears about the trade conflict, pushing many investors away from riskier assets.

Futures markets mirrored the volatility, with Ethereum (ETH) products seeing more than $600 million in liquidations during the last 24 hours, largely during Asian trading hours. XRP and DOGE futures accounted for approximately $150 million of those liquidations, while altcoin-related products lost $138 million. Overall, total liquidations across the crypto market surpassed $2.2 billion, representing one of the largest liquidation events in recent memory. Binance saw the biggest liquidation order, valued at $25 million on a tether-margined ETH position.

“Ethereum’s drastic 20% drop has rattled the market,” noted Augustine Fan, head of insights at SignalPlus. “There’s been massive liquidation activity, totaling over $2 billion, and it’s evident that markets are taking a risk-off approach, awaiting clarity on U.S. equities and trade policy.”

Liquidations occur when traders are unable to maintain their leveraged positions, leading to automatic closure of those trades. While liquidations are typical in the volatile crypto market, the scale of this event suggests broader shifts in market sentiment.

The trigger for this market correction is a trade war that President Donald Trump has revived, with tariffs of 25% imposed on Canadian and Mexican goods. These moves have prompted retaliatory threats from both countries, and China has indicated it will challenge the tariffs at the World Trade Organization. The possibility of escalating trade tensions has raised concerns about rising costs, economic slowdowns, and disruptions to global trade, all of which are contributing to the market’s risk aversion.