XRP Drops 7% as Institutional Selling Overwhelms ETF Inflows

XRP tumbled 7.2% from $2.21 to $2.05 as aggressive institutional selling broke critical support levels, pushing the token back into its November correction range despite strong ETF inflows.

Spot ETF inflows this month totaled $666.6M, led by 21Shares’ TOXR listing, while exchange supply fell 45% over 60 days, reflecting large-scale accumulation. Whale wallets added 150M XRP since November 25, but selling pressure intensified Tuesday amid broad market weakness.

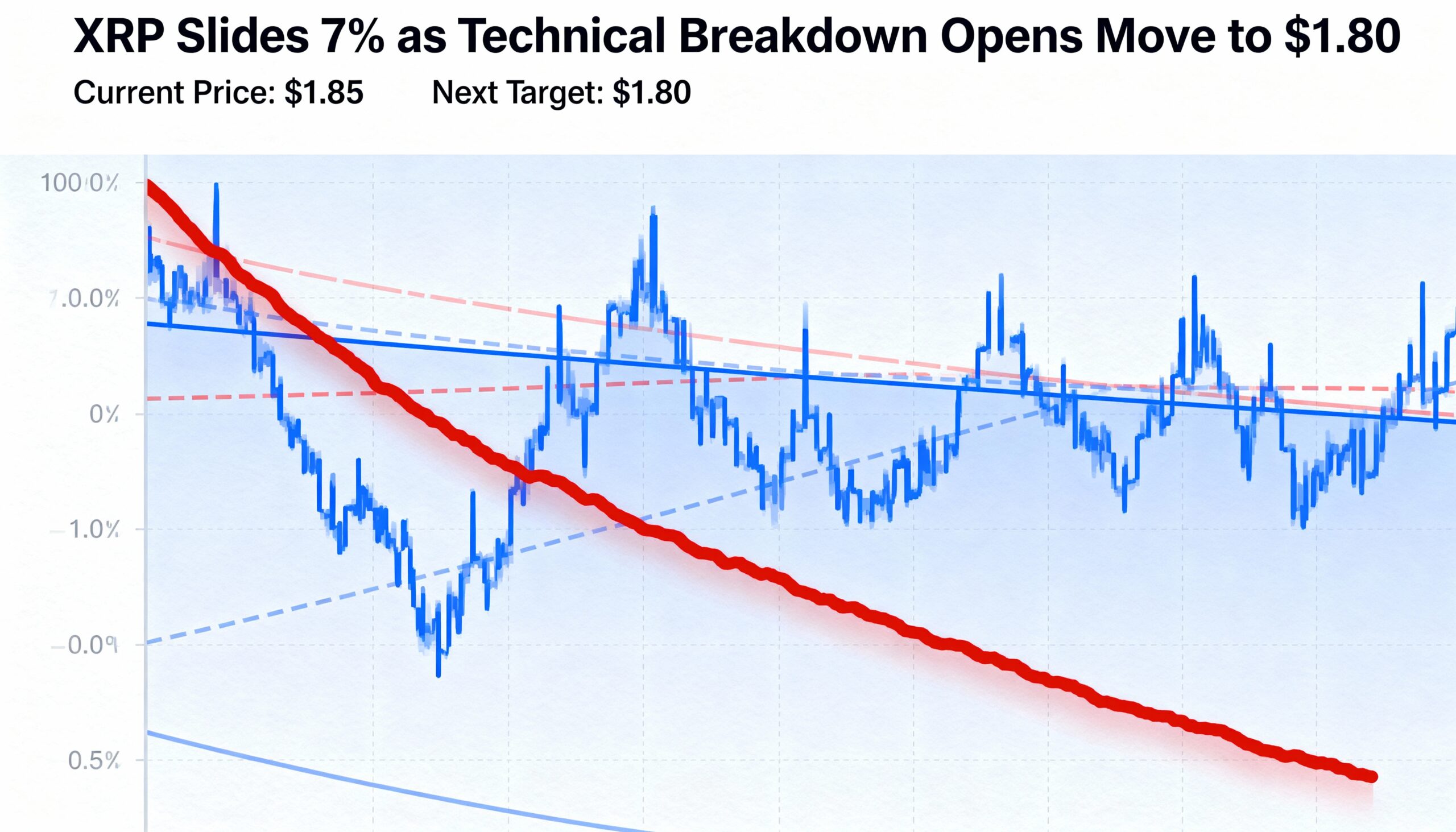

The breakdown below $2.16 marked a decisive failure of XRP’s recent consolidation, pushing it into a descending channel defined by lower highs at $2.38, $2.30, and $2.22. Volume surged to 309.2M—over 4.6× the daily average—confirming institutional exit flows. Retests of $2.05 saw buyers defend the floor, though momentum remains insufficient to reclaim support.

Key Levels:

- Holding $2.05 is critical; a breakdown targets $1.87–$1.80.

- Reclaiming $2.16 is needed to challenge bearish structure.

- ETF inflows support the long-term outlook, but short-term tape remains heavy.

- Watch hourly RSI and MACD for early bullish reversal signals.