Institutional demand via U.S.-listed spot XRP ETFs remains firm, with products continuing to attract net inflows into early January even as price momentum cools.

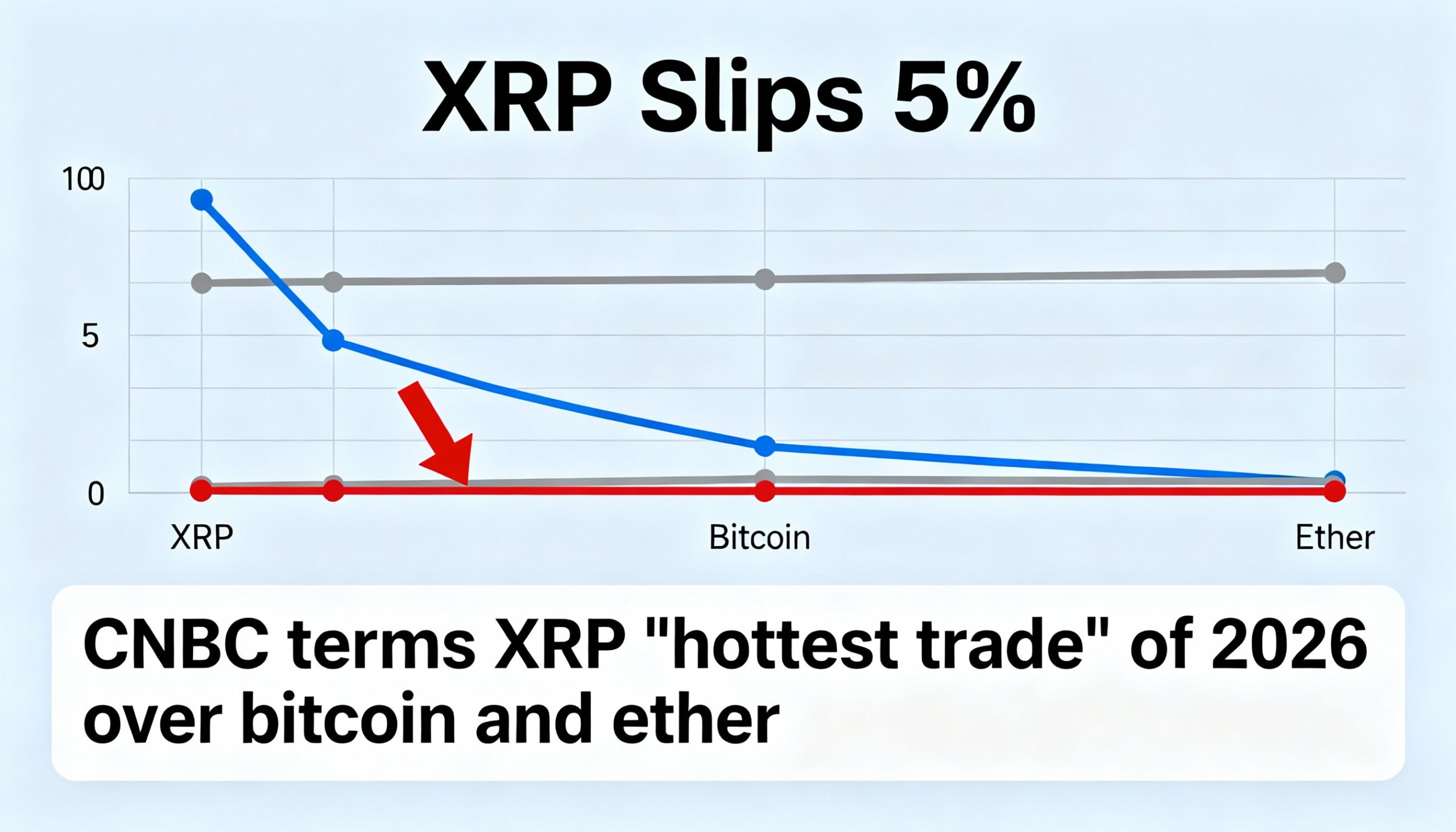

XRP slipped to $2.18 after failing to sustain a break above $2.28, dialing back an early-2026 rally that had been strong enough to earn the token the “new crypto darling” label in a recent CNBC segment. The pullback is a reminder that even the most popular narratives must still work through supply at well-defined resistance levels.

XRP’s strong start to the year has pushed it back into the spotlight after outperforming bitcoin and ether in the first week of 2026. That framing has reinforced the view that leadership within crypto may be shifting, with XRP emerging as a relatively under-owned large-cap alternative while bitcoin remains range-bound and ether struggles to regain traction.

Support for the move has come from steady institutional inflows into spot XRP ETFs. Market data show the funds extending a run of net inflows into January, standing out against the choppier, stop-start flow patterns seen in bitcoin and ether ETFs. The same period has also seen improving network activity, a pickup in bullish social sentiment, and declining exchange reserves — a combination often read as tightening immediately available supply.

Still, the “darling” designation carries familiar risks. Momentum trades can unwind quickly if broader market conditions weaken or if price stalls at major technical levels. That tension is now visible in price action, with XRP failing to hold above key resistance even as the narrative backdrop remains supportive.

XRP fell 4.4% over the 24 hours ending Jan. 8, sliding from $2.28 to $2.18 after repeated rejections at the $2.28 zone gave way to a more decisive selloff. The inflection point came around 15:00 UTC on Jan. 7, when volume surged to 133.8 million — roughly 121% above the 24-hour average — as price rolled over and broke through successive support levels.

The structure of the move suggested active selling into rallies rather than a low-liquidity drift. Volume stayed elevated throughout the decline, with the session printing a clear sequence of lower highs and lower lows as XRP slid toward $2.15, where dip-buying interest finally emerged.

On the 60-minute chart, the rebound that followed was constructive but still tentative. XRP based near the $2.173–$2.174 area, formed a higher low, and recovered into the $2.18–$2.19 range with improving participation. That leaves the market in a familiar position: short-term rebound momentum within a broader structure that has yet to reclaim overhead supply.

The key level remains unchanged. The $2.28 zone continues to act as a clear line in the sand. Until XRP can retake and hold above it, rallies are likely to meet meaningful offers. On the downside, as long as $2.15 holds, the pullback can still be viewed as consolidation within a strong early-year trend rather than the start of a broader reversal.

The broader narrative — ETF inflows, constructive sentiment, and declining exchange reserves — remains intact. But the tape is sending a clear message: $2.28 is still a distribution area, and the market is not yet willing to price through it without stronger follow-through.

The levels are well defined. A reclaim of $2.20 followed by a sustained move above $2.28 would reset momentum higher, opening room toward the $2.30–$2.32 supply zone and potentially the upper end of the broader range. A failure of $2.15, however, would likely rotate price toward the next demand pocket near $2.10, with $2.00 coming back into view if risk appetite softens across major tokens.

For now, the near-term signal lies in volume behavior: whether rebounds continue to attract rising participation or fade again into resistance.

Bottom line: XRP remains an early-year leader, but this session underscores a familiar truth — outperformance does not eliminate resistance, it simply defines where conviction is tested next.