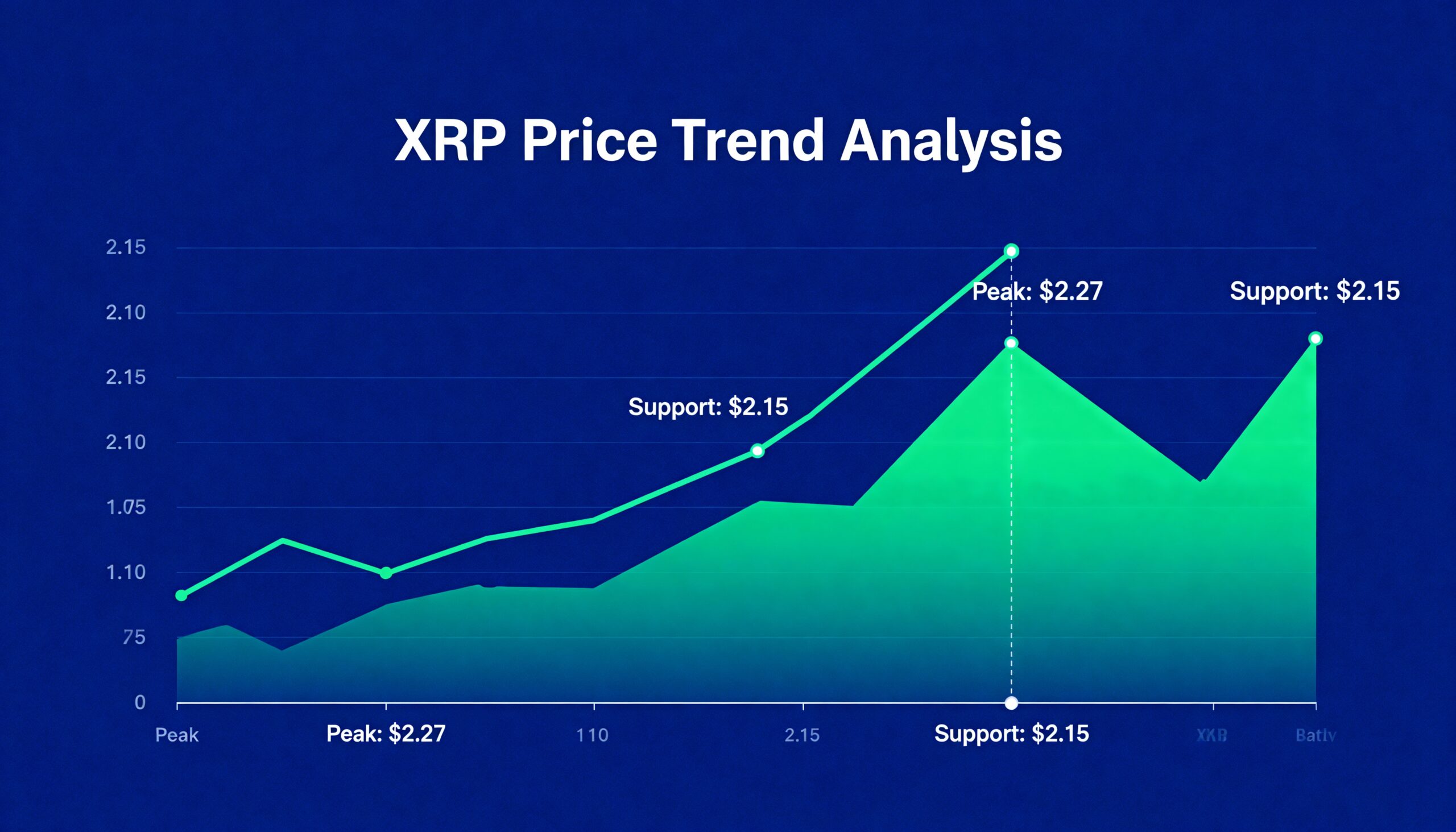

XRP Slides Toward $2.15 Amid Technical Pressure Despite ETF Boost

XRP fell from a $2.27 intraday high to trade near $2.15–$2.17, confirming a short-term breakdown in its bullish structure. Traders are eyeing the $2.15 pivot closely, as holding it could trigger a rebound, while a break below may open the door to losses toward the $1.98 support zone.

ETF Activity and Market Context

November saw multiple XRP ETFs launch, including Franklin Templeton’s EZRP, Canary Capital’s XRPC, and several Bitwise products. First-week flows exceeded $245 million, signaling strong institutional demand, though ETF trading volumes have dropped 55% from peak levels, highlighting waning retail participation.

Broader crypto markets softened as Bitcoin volatility rose ahead of its Death Cross, pulling altcoins lower. ETF optimism provided limited support as fragmented liquidity restricted sustained upside for XRP.

Price Action & Technical Signals

- XRP declined 4.96% from $2.27 to $2.16, briefly dipping below $2.20.

- Session volume surged 54.5% above monthly averages, with 236.6M XRP traded.

- Resistance holds at $2.28, while consolidation around $2.155–$2.166 suggests temporary seller exhaustion.

- A bearish pennant has formed between support at $2.155 and descending resistance near $2.18.

Momentum remains bearish with price below key EMAs. A breakout above $2.18–$2.20 and reclaiming $2.28 is required for bulls to regain control. XRP’s near-term path will also depend on Bitcoin’s volatility post-Death Cross.