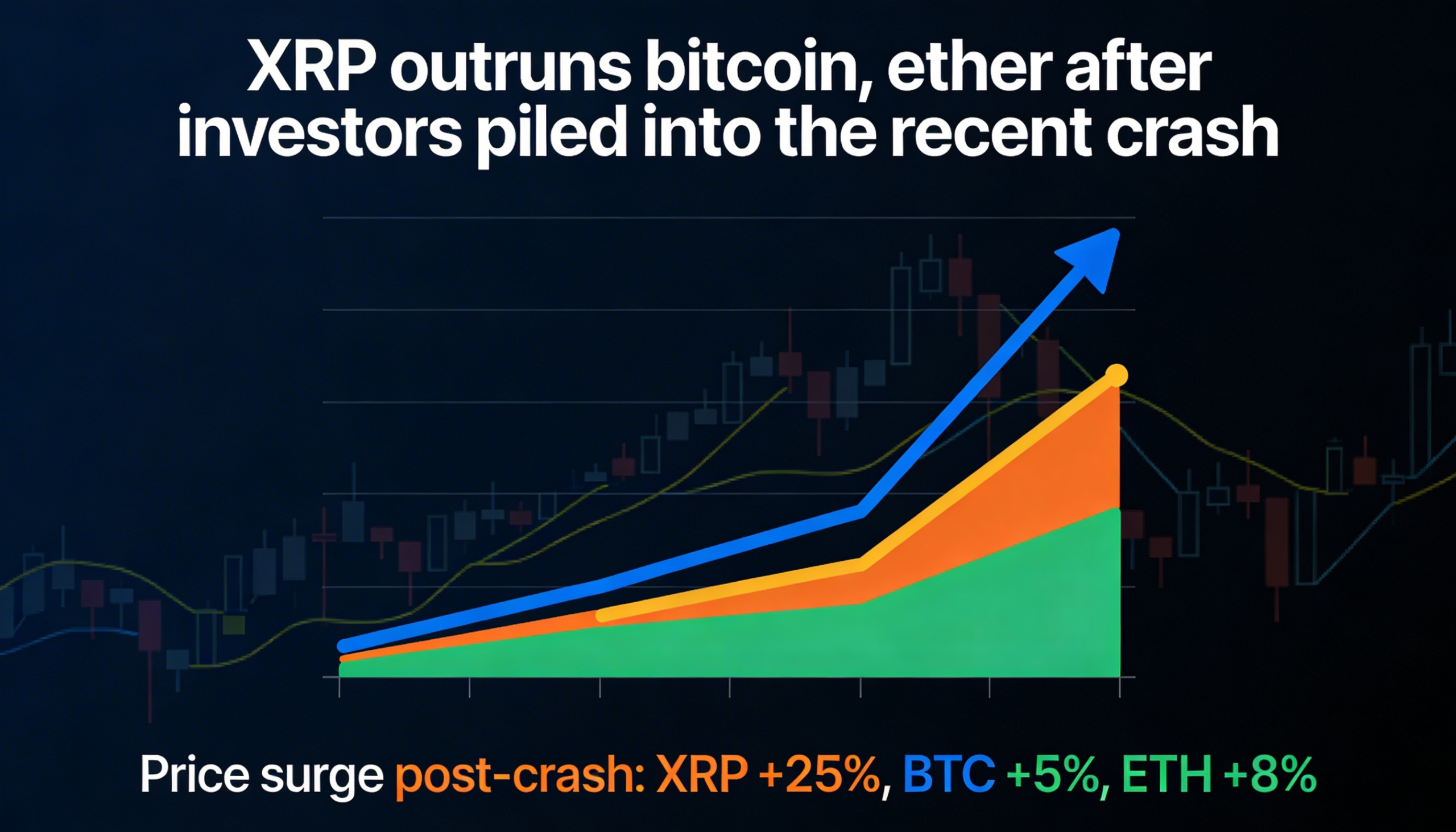

XRP is outpacing both Bitcoin and Ethereum as investors step in to buy the dip following this month’s sharp market sell-off.

The payments-focused token has surged about 38% to $1.55 since bottoming on Feb. 6, according to data from CoinDesk. In the past 24 hours alone, XRP has climbed more than 5%.

By comparison, bitcoin and ether have gained roughly 15% over the same period, recently trading around $69,420 and $2,020, respectively. XRP’s stronger rebound suggests traders have been more aggressive in rotating into the token after the downturn.

On-chain data points to notable dip-buying activity on Binance. Metrics from CryptoQuant show Binance’s XRP reserves fell by 192.37 million tokens to 2.553 billion between Feb. 7 and Feb. 9. The 7% decline pushed exchange balances to their lowest level since January 2024, with holdings stabilizing afterward.

A drop in exchange reserves is often interpreted as a sign of accumulation, as investors move tokens into self-custody for longer-term holding rather than keeping them readily available for sale on trading platforms. Large withdrawals can tighten available supply, potentially supporting higher prices.

Past trends lend weight to that view. XRP previously rallied from around $0.60 to above $2.40 in the final two months of 2024, coinciding with a sustained decline in exchange-held balances.