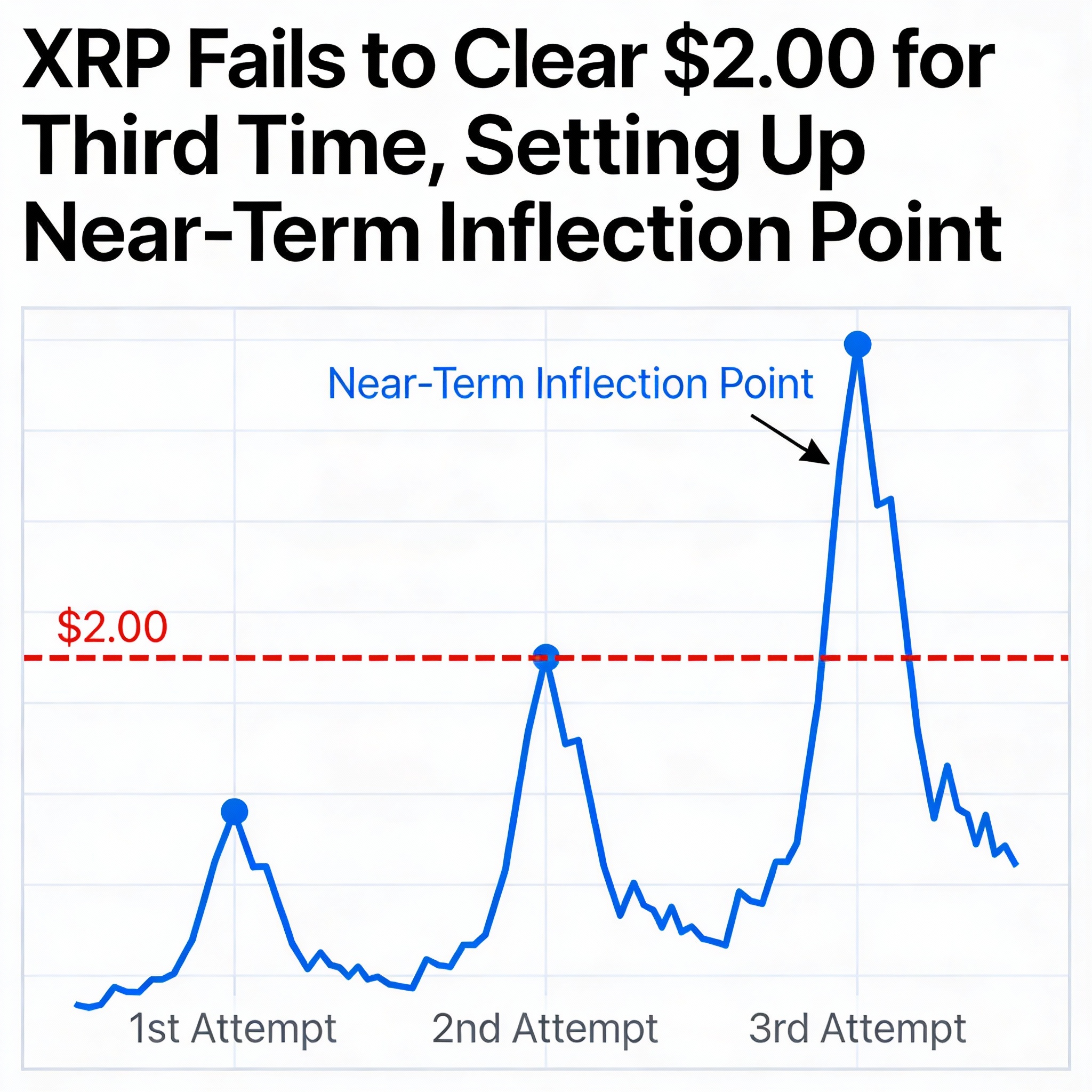

XRP Hits Resistance at $2.00 Despite Institutional Support

XRP continues to struggle at the $2.00 psychological level, with rising volume signaling active selling even as institutional developments provide a supportive backdrop.

Market Context

Following the Federal Reserve’s 25-basis-point rate cut to 3.5%–3.75%, broader crypto markets showed some strength, but XRP has yet to follow through. Fed dissent over inflation has limited speculative upside, keeping price action muted.

Institutional support remains positive. U.S. spot XRP ETFs have recorded steady inflows, and ecosystem expansions—including custody, DeFi, and cross-chain integrations—highlight long-term adoption trends. However, these fundamentals have not yet translated into decisive gains on the charts.

Technical Overview

XRP is capped under $2.00–$2.01, a resistance zone that has rejected price three times, each accompanied by rising volume—most recently 186% above average—indicating sellers are actively defending the level. Momentum indicators remain mixed, with RSI stable but not bullish and intraday structure forming lower highs below $2.03.

Price is consolidating between support at $1.97–$1.98 and supply at $2.00–$2.01. Late-session rebounds briefly pierced $2.00, but follow-through was limited.

Trader Takeaways

- Sellers remain in control until a sustained break above $2.01.

- A clean breakout could target $2.15–$2.20.

- Holding $1.97 is critical to avoid a slide toward $1.90–$1.92.

- ETF inflows and ecosystem growth provide underlying support.

- Range-bound strategies remain dominant until a decisive breakout or breakdown occurs.