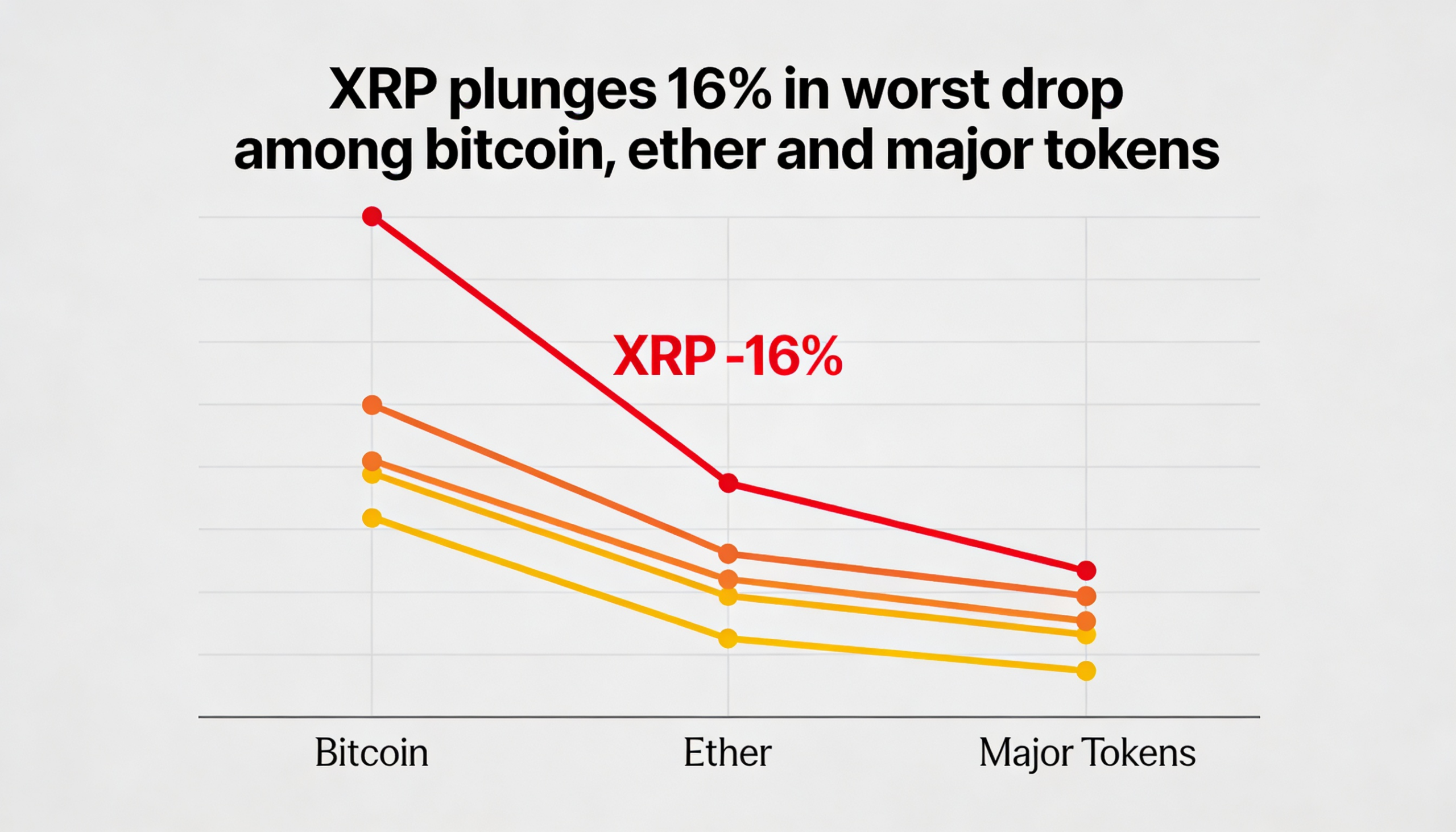

XRP plunged more than 16% over the past 24 hours to around $1.29, underperforming major tokens as bitcoin fell 7% on Thursday.

The decline was amplified by forced selling in derivatives markets. Coinglass data shows roughly $46 million in XRP liquidations during the past day, with about $43 million coming from bullish leveraged positions. This indicates the sell-off was driven not only by spot holders exiting but also by leveraged traders being wiped out as key price levels broke.

The price action reflects a slow bleed through much of the session, followed by a sharp late drop — a pattern typical of markets where buyers gradually step aside until a final cascade of stops accelerates the decline.

XRP’s slump comes despite positive fundamental developments for both the token and its associated company. Earlier this week, Flare and Hex Trust announced institutional access for FXRP minting and FLR staking, enabling institutions to use XRP in DeFi without selling it. Yet the news failed to buoy sentiment, suggesting traders either see limited near-term demand from institutions or doubt sizable flows are imminent.

Ripple also secured e-money licenses in Luxembourg and added Hyperliquid to its institutional prime brokerage platform, Ripple Prime, giving clients access to on-chain perpetual liquidity. While such developments can boost a token’s appeal during bull runs, they were not enough to counteract the current technical and leveraged selling pressures.

Technically, the drop below the $1.44 area flipped what had been support into overhead resistance. Below current levels, the next major psychological target is $1.00, as there is little recent trading history in between.

For now, XRP is trading like a leverage unwind disguised as a fundamentals story — and neither dynamic appears fully resolved.