XRP ETF Inflows Exceed $1 Billion as Institutions Accumulate Amid Quiet Retail Demand

Market Overview

U.S. spot XRP ETFs continue to attract strong institutional interest, with total inflows now surpassing $1 billion since launch — the fastest adoption rate for any altcoin ETF. While retail engagement remains muted, large investors are steadily accumulating during market dips. This has created a dynamic where institutional demand offsets lighter retail participation.

Macro trends show capital rotating into regulated products, with ETF inflows counterbalancing declining derivatives open interest.

Technical Analysis

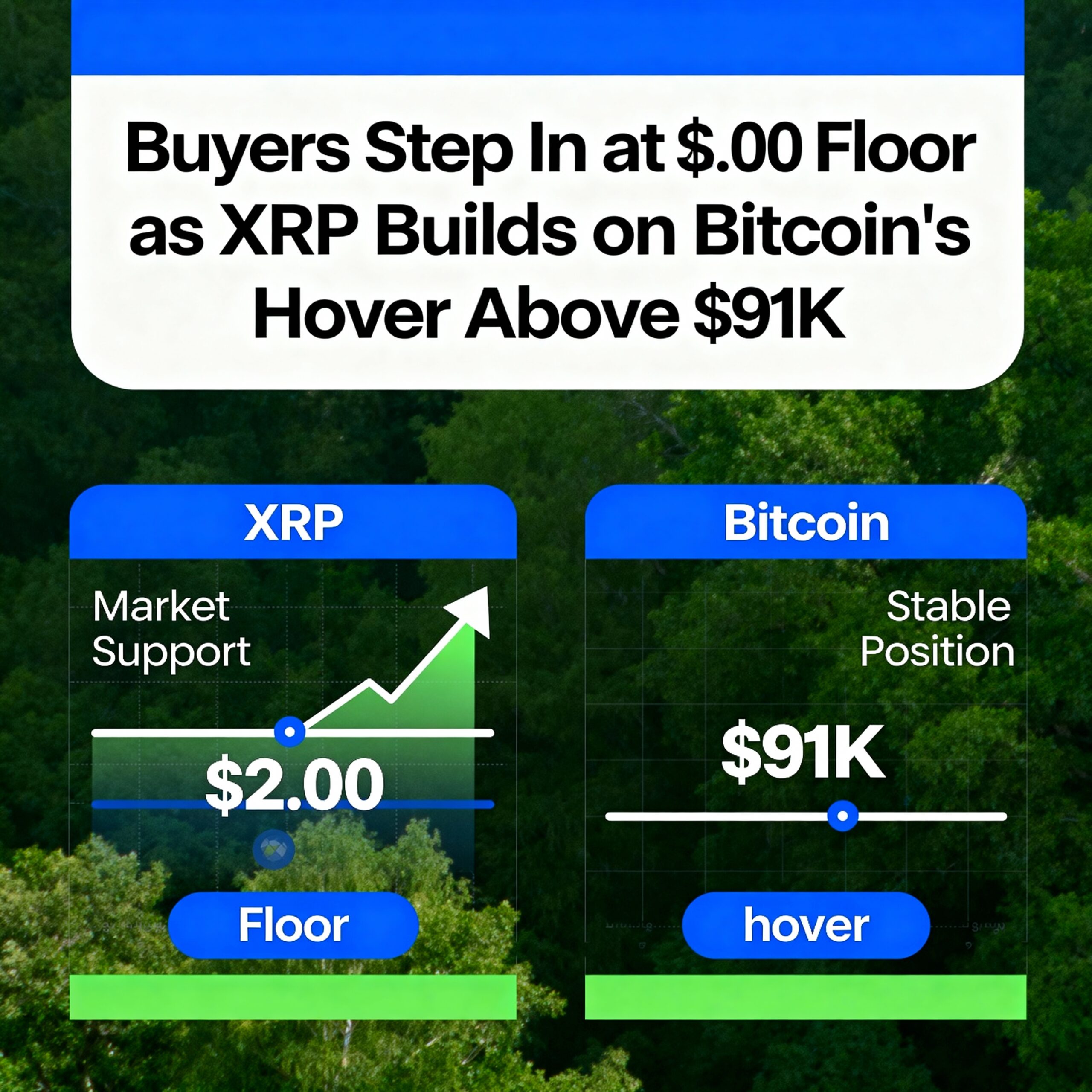

The session’s highlight came during the $2.03 → $2.00 dip, when volume surged to 129.7M, 251% above the 24-hour average. Heavy selling was met with institutional buying at the psychological $2 floor, producing a V-shaped rebound to $2.07–$2.08.

XRP is forming higher lows on intraday charts, signaling early trend acceleration. Resistance remains between $2.08–$2.11, and momentum indicators show bullish divergence, though sustainable upside will require volume expansion during rallies, not just during sell-offs.

Price Action

XRP traded in a $2.00–$2.08 range, with a sharp floor test immediately absorbed by buyers. Multiple intraday attempts to breach $2.08 failed, keeping price capped despite improving structure. Consolidation near $2.06–$2.08 indicates stabilization above support, though the broader range remains compressed as the market looks for a catalyst.