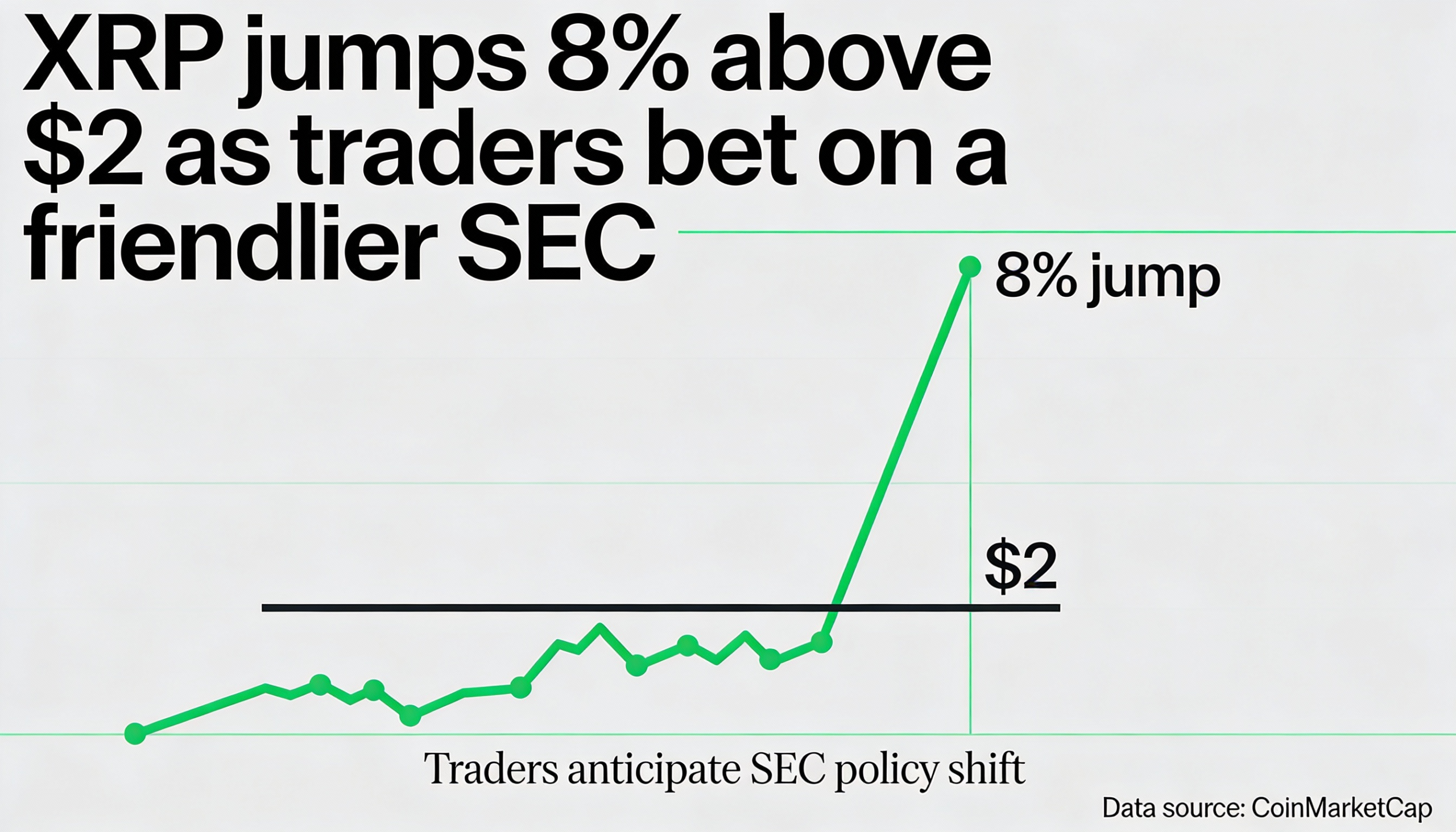

XRP pushed above the $2 mark on Friday for the first time since mid-December, extending a strong start to 2026 as traders pointed to steady spot ETF inflows and a more constructive U.S. regulatory outlook.

Data from SoSoValue showed U.S. spot XRP ETFs recorded net inflows of $13.59 million on Jan. 2, lifting cumulative inflows since launch to $1.18 billion. The continued demand has supported near-term supply-and-demand dynamics for XRP, even as broader crypto benchmarks remain largely rangebound.

Market participants also reassessed the regulatory backdrop following the departure of SEC Commissioner Caroline Crenshaw, a development some traders see as opening the door to a more crypto-friendly policy stance. Crenshaw had been one of the most outspoken critics of crypto spot ETFs and had opposed the SEC dropping its appeal in the Ripple case, according to market commentary.

Speculation around forthcoming legislation further fueled the move. Traders cited a potential Market Structure Bill markup scheduled for Jan. 15, keeping regulatory expectations elevated into the first quarter and contributing to XRP’s relative outperformance.

XRP’s rally contrasted with mixed flows across other major crypto ETFs. The same data showed softer demand for bitcoin funds, reinforcing the view that XRP’s gains are being driven by token-specific catalysts rather than a broader risk-on shift.

XRP was last trading just above $2, up roughly 8% on the day. Bitcoin hovered slightly above $90,000, while ether traded near $3,000, both posting only modest gains.